Tag: Morgan Stanley

Mixed results at dealers as rates and FX power US Q4...

JPMorgan had the largest fixed income, currencies and commodities (FICC) revenues amongst US banks at US$5.4 billion for the last quarter of 2025 with Goldman showing the strongest year on year growth on rates and FX trading. Citi and BofA FICC results were...

How e-trading won bond investors an opportunity in the Venezuelan crisis

The dramatic escalation of Venezuela’s political crisis — culminating in the US military operation that removed Nicolás Maduro from power — has triggered a...

‘Disbelief’ is becoming market response to US policy announcements

The failure to support policy and public announcements by the current US administration has hurt investors enough that they no longer react to public...

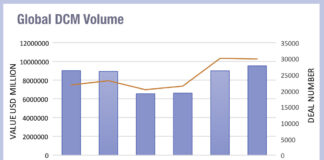

Dealogic: DCM deals in 2025 up 18% on five-year average

The preliminary view of 2025 capital markets deals, published by Dealogic, has found that global DCM volume delivered a total of US$9.5 trillion, 19%...

IG issuance across US and Europe up 20% on five-year average

US investment grade debt issuance has hit $1.7 trillion year to date (YTD) in 2025, a 12% increase year on year (YoY). That brings...

Milei’s victory saw Argentinian debt traders reach for rapid risk transfer

In late October 2025, Argentine President Javier Milei’s party, La Libertad Avanza, scored a decisive win, in the country’s midterm elections, a political triumph...

I just dropped in to see what condition my credit was...

Credit conditions are in the headlines following several private credit defaults, and the debt-fuelled, forward investment in data centres which are expected to underpin...

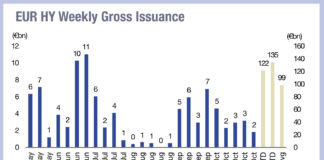

Issuance tracking down in lower rated debt

Issuance of lower rated bonds and leveraged loans across Europe and the US fell in October, according to analysis by investment bank Morgan Stanley,...

Banks buy into LSEG’s Post Trade Solutions

Banks using LSEG’s post-trade solutions have taken a 20% stake in the business, paying £170 million for the shares.

The transaction is expected to close...

While rates trading hummed in Q3, “cockroaches” hide

Jamie Dimon, CEO at JP Morgan, warned that recent corporate blow-ups may presage wider credit issues: “When you see one cockroach, there are probably...