Tag: Thomson Reuters

FILS in Barcelona: If the future is futures, what happens when...

Moving liquidity from the spot or cash markets into futures is raising some concern amongst market participants. In FX, trading volume on the Thomson...

U.S. Credit Trading Q&A: Jim Kwiatkowski, LTX

Jim Kwiatkowski was named CEO of LTX, Broadridge Financial Solutions’ artificial intelligence (AI)-driven digital trading business, in November 2022. Markets Media caught up with Jim to learn more...

A road less travelled

Aparajita Bose-Mullick, Global Product Manager at SmartStream Technologies - Reference Data Utility, talks about carving new paths, cause & effect and being nimble.

There are...

Tradeweb part of LSEG / Refinitiv deal

After a flurry of rumours the London Stock Exchange Group (LSEG) has confirmed that it is in talks to acquire Refinitiv, a leading global...

Brokertec data shifts to Bloomberg with Reuters/Dealerweb data tie-up

By Shobha Prabhu Naik & Dan Barnes.

Bloomberg, the financial data provider, has launched a new data service that will take NEX’s BrokerTec US Treasuries...

The syndication trader

A syndication specialist could improve operational efficiency and give asset managers greater control over primary market activity, writes Dan Barnes.

As primary markets evolve, a...

Trading Intentions Survey 2017: US Focus

Firms with US credit desks are checking out Algomi, KCG Bondpoint and Trumid.

About the survey: The Trading Intentions Survey is conducted by The DESK, asking...

Subscriber

BTIC: Bloomberg terminal users declined in 2016

Spend on market data, analysis and news has topped US$27 billion for the first time according to Burton-Taylor International Consulting’s latest report. The findings...

Making prices more easily

If dealers cannot make prices investors will have to, and many firms are stepping up to offer greater access to pricing and liquidity data....

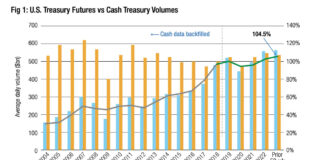

Dealers need to go with the flow

Broker-dealers must become more technologically savvy in the derivatives space if they want to impress buy-side clients. Lynn Strongin Dodds reports.

Multi-asset trading is increasingly...