Tag: Tradeweb

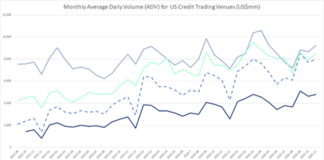

E-trading flat as US credit volumes balloon

Electronic trading in US credit showed little movement between 2024 and 2025, hovering just below 50% of investment grade (IG) volumes and remaining at...

Tradeweb expands multi-asset package trading

Tradeweb has launched multi-asset package trading for USD-denominated swaps, following the success of the product in Europe.

The functionality allows institutional users of Tradeweb’s swap...

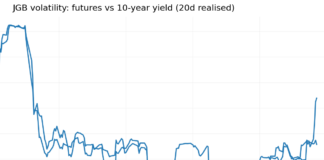

Japanese bond vigilantes have a JGB one-way bet

Front-month ten-year Japanese Government Bonds (JGBs) futures are down 7% since early 2025 as volumes spike on down days, while the 10-year yield has...

Cross-asset TCA is viable in credit markets

Can transaction cost analysis (TCA) provide an apples-for-apples comparison of buy-side trading costs across different asset classes? Imposing a single measurement framework across markets...

Human battles machine in JGB market

Participants say electronic trading of Japanese government bonds has reached an inflection point, but others counter that the death of voice trading has been...

Are bigger trades always better?

Average trade sizes appear to have been increasing in corporate bond markets in recent years. Superficially this might suggest a greater dealer capacity to...

Tradeweb: Transforming Japan’s trading landscape

Transforming Japan’s trading landscape

By Taichi Shibuya, Head of Japan, Tradeweb

How is the market structure for Japanese government bond (JGB) trading divided between electronic and...

Tradeweb and MarketAxess beat TRACE growth in November

US electronic credit activity firmed in November. On FINRA’s TRACE tape, combined US investment-grade and high-yield average daily volume (ADV) rose to US$57.8 billion,...

Opportunities in e-trading credit derivatives

Credit futures and swaps complement each other by providing investors with different but interconnected tools to manage credit risk, hedge exposures, and to gain...

MarketAxess outperforms competition in October through slower month

US electronic credit trading slowed down in October. FINRA’s TRACE tape recorded combined US investment-grade (IG) and high-yield (HY) average daily volume (ADV) at...