Convertible and exchangeable bond issuance in APAC is on track for a record-breaking year, Citi has noted.

Convertible bonds allow holders to convert their bond into shares of the issuer. Exchangeable bonds can be exchanged for shares of a company other than the issuer, generally a subsidiary.

According to Dealogic data, close to US$21 billion across 108 issues has been raised in the region to date. Citi expects to see this trend continue in the second half of the year.

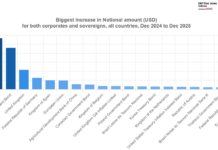

Globally, US$69 billion was issued in such equity-linked notes over the first half of the year – up 15% year-on-year. The bulk of this was issued in the Americas, followed by APAC and EMEA.

Rob Chan, head of Asia equity capital markets syndicate at Citi, commented, “Pipelines across the market are strong and long with a range of issuers looking to access the market. Our advice to potential issuers is to make necessary preparations early, to gain flexibility on accessing an optimal execution window.”

So far this year, the bank has led public convertible/exchangeable transactions for firms including Alibaba Group (US$1.5 billion), Nissan Motor (US$1.4 billion), Qifu Technology (US$600 million) and KCC (US$625 million).

©Markets Media Europe 2025