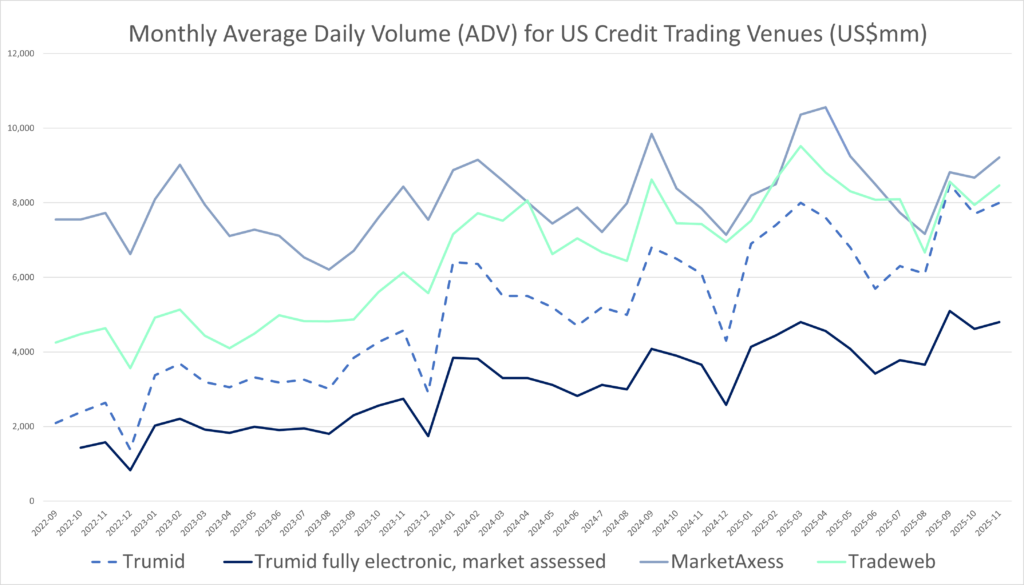

US electronic credit activity firmed in November. On FINRA’s TRACE tape, combined US investment-grade and high-yield average daily volume (ADV) rose to US$57.8 billion, up 5.8% month on month (MoM) and 18.6% year on year (YoY). Within our fully electronic HY+IG panel, MarketAxess ADV was US$9.2 billion, up 6.3% MoM and 17.5% YoY, both outpacing TRACE’s monthly. Tradeweb printed US$8.5 billion, up 6.3% MoM and 13.9% YoY. Trumid reported ADV of US$8 billion up 3.9% MoM and 31% YoY.

Market sources’ assessments of Trumid trading indicate that, adjusting for processed trades, its fully electronic trading volume should be adjusted down by approximately 40% to US$4.8 billion. We have provided the ‘market assessed’ e-trading volume in our comparative visualisation.

MarketAxess

MarketAxess’s US high-grade ADV was US$7.6 billion and high-yield ADV US$1.6 billion in November, taking HY+IG to US$9. billion and implying 17.3% of TRACE HY+IG market share for the month. Market Axxess said its estimated US high grade share rose to 18.5% ex-single-dealer program trading (PT), up 40 basis points MoM, and US HY share to 13.2% ex-single dealer program trading up 10 bps m/m. Variable transaction fees per million for total credit were US$139 down 1% MoM and down 5% YoY−1% m/m; −5% y/y. It said this reflected changes in protocol mix partially offset by the higher duration of bonds traded in US high grade. It said channel metrics stayed strong with block-trading ADV up 46% YoY; portfolio-trading ADV was up 47% YoY to US$1.4bn; dealer-initiated ADV +32% year-on-year.

Tradeweb

Tradeweb reported fully electronic US credit ADV of US$8.5 billion, up 13.9% YoY. Tradeweb said its share of US high grade and US high yield electronic trading were 17.1% and 8.4% respectively. Cash-credit PT ADV increased 5% YoY, while non-comp PT fell 10% YoY; the firm reiterated that PT carries a lower fee per million than broader cash credit.

Trumid

Trumid reported November ADV was US$8 billion, up 32% YoY, with list-based protocol volumes doubling YoY and RFQ participation at new highs. The firm highlighted continued automation via AutoPilot and strength in high yield, where HY ADV rose 38% YoY.

Trumid is a private company and does not disclose volume by trading protocol, however, market sources have confirmed to The Desk that a majority of its long-established attributed trading protocol (D2C) could be considered processed volume, not fully electronic which is the measure used for MarketAxess and Tradeweb. As such we now present both a Trumid reported number and a ‘market assessed’ number for fully electronic ADV, which is 40% lower volume than has been historically reported.

©Markets Media Europe 2025