Average daily volume reported on TRACE for US investment grade (IG) and high yield (HY) dropped a further 9% month-on-month (MoM) in June to US$49.8 billion. IG fell to US$37.2 billion (-10.7% MoM), while HY retreated more modestly to US$12.6 billion (-3.5% MoM).

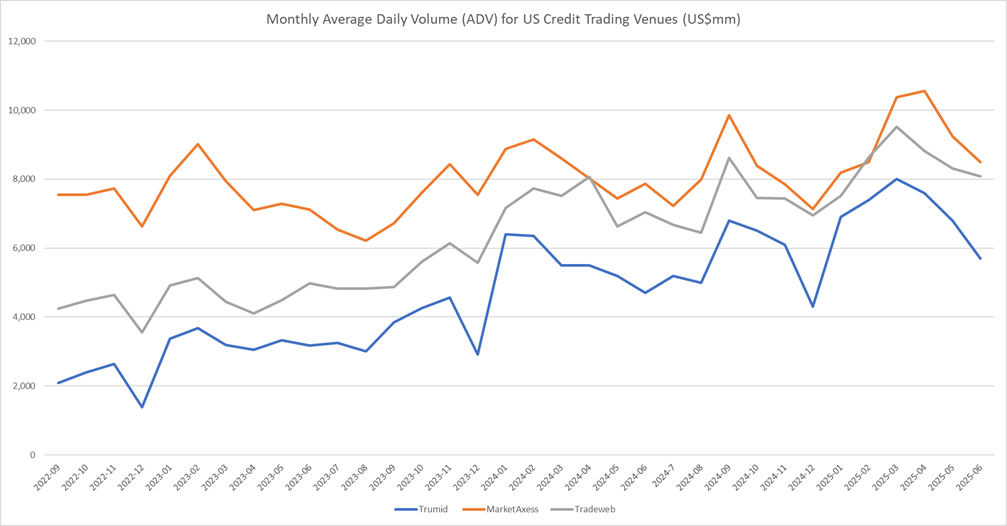

Tradeweb fully electronic US credit average daily volume (ADV) fell to US$8.1 billion, down 2.7% MoM but up 14.6% year-on-year (YoY). US investment grade fully electronic trading ADV was US$7.1 billion, down 2.3% MoM but up 12.9% YoY, while HY electronic trading ADV was US$994 million, down 5.9% MoM and up 29.3% YoY.

Tradeweb noted that its European credit trading was flat YoY at US$2.5 billion and up 3.9% MoM, with volume notably suppressed at the beginning of the month by geopolitical events. It stated the growth year-on-year is attributable to increased adoption of its trading protocols.

The company reported that its rates trading ADV was US$1.26 trillion, including swaps and futures, down 5.1% MoM but up 6.5% YoY Its reported US government bond ADV was down 5.3% MoM but up 6.1% YoY at US$223.6 billion.

MarketAxess reported US credit electronic ADV of US$8.5 billion, down 8.2% MoM but up 7.9% YoY. Investment grade ADV was US$7 billion, retreating 8.5% MoM but gaining 5.7% YoY, while HY electronic trading ADV was US$1.5 billion, decreasing 6.6% MoM but up 19.6% YoY.

Rates ADV in June was US$27.4 billion, down 8% MoM but up 22% YoY. The firm attributed this growth to clients making more use of its algo capabilities in US government bond trading, supported by activity in its wholesale channel.

While emerging market credit trading was up 15.4% to US$4.2 billion, expanding 15.4% MoM and 15.8% YoY, Eurobond trading was down 16% MoM but up 19.8 YoY to US$2.4 billion. MarketAxess attributed lower trading ADV to volatility subsiding.

Private venue Trumid reported ADV US$5.7 billion, 16.2% below May’s peak yet up 21.3% YoY. It stated that its Trumid Request for Quote (RFQ) and portfolio trading (PT) activity reached a new record in June, and that buy-side engagement continued unabated. It also said that HY trading was an area of strength in Q2.

The platform does not break out IG versus HY, limiting direct comparisons with its listed rivals.

©Markets Media Europe 2025