Informed traders are discovering that newer approaches to executing trades are more successful than older, habitual paths.

The DESK spoke with Max Callaghan of MarketAxess and Ramon Baljé of Flow Traders, about the quantitatively better execution results traders can get by combining analytical pre-trade insights with a broader set of counterparties.

The DESK: Why might buy-side traders need to change habits in European bond markets?

Max Callaghan: In 2022 we’ve continued to see an evolution in the nature of liquidity, although this year, more than any other, the evolution has been a function of the macro and interest rate backdrop. The ability of the buy or the sell side to position and/or recycle risk has been more complex, with one-way inventory positioning a heightened concern. Even in market segments where there are clear and longstanding market-makers, conditions have been such that the provision of balance sheet has been more costly than expected pre-trade.

So, amongst other things, this has led to a more detailed re-analysis of the historical model of taking an order to a single market maker and assuming they will be able to fill it.

Ramon Baljé: Beside the current market dynamics we believe there are also longer term trends at play. We see that the characteristics of orders has changed in European credit trading. For example, around 75% of tickets in European investment grade (IG) trading are in the up to €1 million bucket, up 18% between 2019 and 2021, which are making up approximately 25% of volume. That is a massive change. For a buy-side trading desk, handling investment grade trades – which typically contain bonds of a more consistent liquidity profile than high yield orders – can be largely an issue of managing the volume of tickets being traded, more than the order size to an extent. As a result, we are seeing traders move towards the use of low-touch trading methods in European IG.

Can you give examples of these changes?

MC: MarketAxess research into counterparty selection shows that there is a correlation between request-for-quote (RFQ) distribution to multiple dealers and lower transaction costs. This is in part a function of changing dealer attitudes; for example, electronic market makers, instead of fighting for non-comp trades, actually want to be in competition with many other market makers. New liquidity capacity from the exchange-traded fund (ETF) market-maker model, which doesn’t have the same constraints as traditional dealers, offers a different avenue of liquidity that helps to address the issues in the market as a whole.

We, of course, are always acutely aware of our need to provide trading solutions which support these changing dynamics – no more so than when thinking about different trade sizes and the nature of the protocols with which clients can execute them.

RB: If we break trading down volumes for European IG into buckets based on order size for tickets up to €1 million and even for more liquid ISINs up to €2.5 million, the world has completely changed. We also see that for trading up to certain sizes, a buy-side trader should show multiple counterparties their trades because the more dealers they expose an order to, the better execution becomes – measured in amount of prices and transaction cost analysis (TCA).

MarketAxess has actually done some great studies which show that going ‘all-to-all’ generates real transaction cost savings. For more liquid ISINs trading €2-3 million is very much an all-to-all market. For larger sizes different execution styles are necessary due the nature of credit markets i.e. pre-trade analysis like axes, dealer performance and relationships become more important. We expect the trend of automation in the larger buckets also to continue as a result of improved data quality, more algorithmic trading, and innovation.

MC: I would add that new investment strategies also play a part here For example, the rising prevalence of systematic investment in fixed income credit adds pace to the evolution of trading styles and market structure. The changing nature of participants serves to add alternative liquidity even in volatile or complex markets.

RB: This is a really interesting point Max makes. We believe that European IG credit markets are at the same inflection point that we have seen in ETFs. Around these inflection points we see a lot of innovation and new players driving change which leads to new possible trading styles and protocols. This momentum will very likely drive up the amount of e-trading and trading on venues like MarketAxess

Are traders aware of these changes?

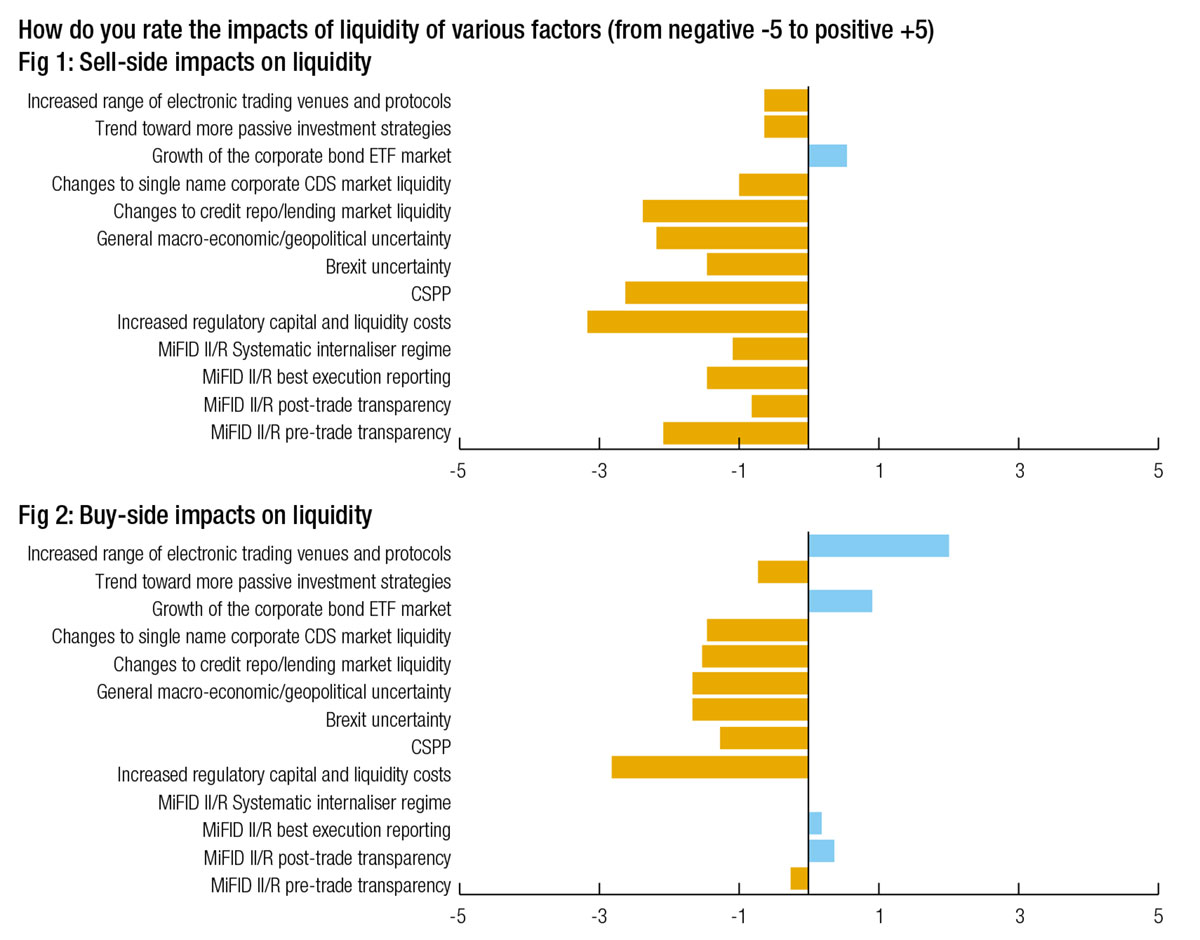

RB: Some of the changes, for example, alternative market makers and automated trading strategies from banks entering the arena, were highlighted in an ESMA paper in 2020, which found that electronic trading and ETF market developments were the two big positives to adding liquidity into the market (see Figures 1 & 2).

We believe that buy-side traders are aware of the advantages of ETF market-makers in the bond market who bridge, amongst other things, the liquidity between the ETF ecosystem and the bond market. Additionally, we see more and more buy-side parties moving towards a high- and low-touch model. For the latter, a fully automated approach is obviously required and offered by more automated or algorithmic trading set-ups like Flow Traders.

MC: While we’ve seen market structure and trading protocols change significantly, in decentralised or over-the-counter (OTC) markets like ours these changes and trends often take longer to really proliferate and normalise. Their benefits can unfortunately be “overlooked” during volatile periods and in complex markets. We’ve seen this a little recently, especially as the rate cycle has changed rapidly and – in many markets – for the first time in many years. Many market participants may have limited experience of such volatility and which tools work best in such an environment. So while electronic platforms like us have evolved our toolkits substantially during this period, we need to keep proving the thesis to clients that these toolkits help in both liquid and illiquid market conditions.

What can lower the barriers to awareness?

RB: Studies like the one mentioned above by MarketAxess really quantify the advantages of new trading styles and the benefits of this low- and high-touch model. Additionally, the rise of algorithmic trading is a recent trend which makes up almost 50% of electronic tickets. This innovation with respect to algorithmic or automated trading as well as improvements to good quality pre- and post-trade data will help lower these potential barriers of awareness.

MC: Access to data, and of course the quality of that data, can significantly improve a trading desk’s use of new trading approaches. With the right analytics, new routes to best execution are clearly visible. However, the benefits can be undone if the data onboarding is fragmented, or if the data and analytics are scrutinised in a piecemeal fashion. Finding a provider who can deliver both the data, the workflow and the analytics, and integrate them easily into the trading desk, is key.

What are the next steps for traders to break out of old habits?

RB: We are firm believers of fully transparent markets and think the evidence we have presented should show that different styles for different size buckets are still required however the trend is in favour of automation . The message which might sound strange from a dealer is this: for trades up to €1 million for European IG you will have better execution the more dealers you select, so we encourage this.

MC: We see data as the starting point, but also connectivity. As Ramon notes, traders need access to more liquidity providers as well as the ‘right’ liquidity providers. We work with firms of all sizes to ensure clients can find the right liquidity partner for the right trade, at the right time – but crucially we can provide data which can continuously assess such partners’ ‘value add’, in the good times as well as the bad.

©Markets Media Europe 2025