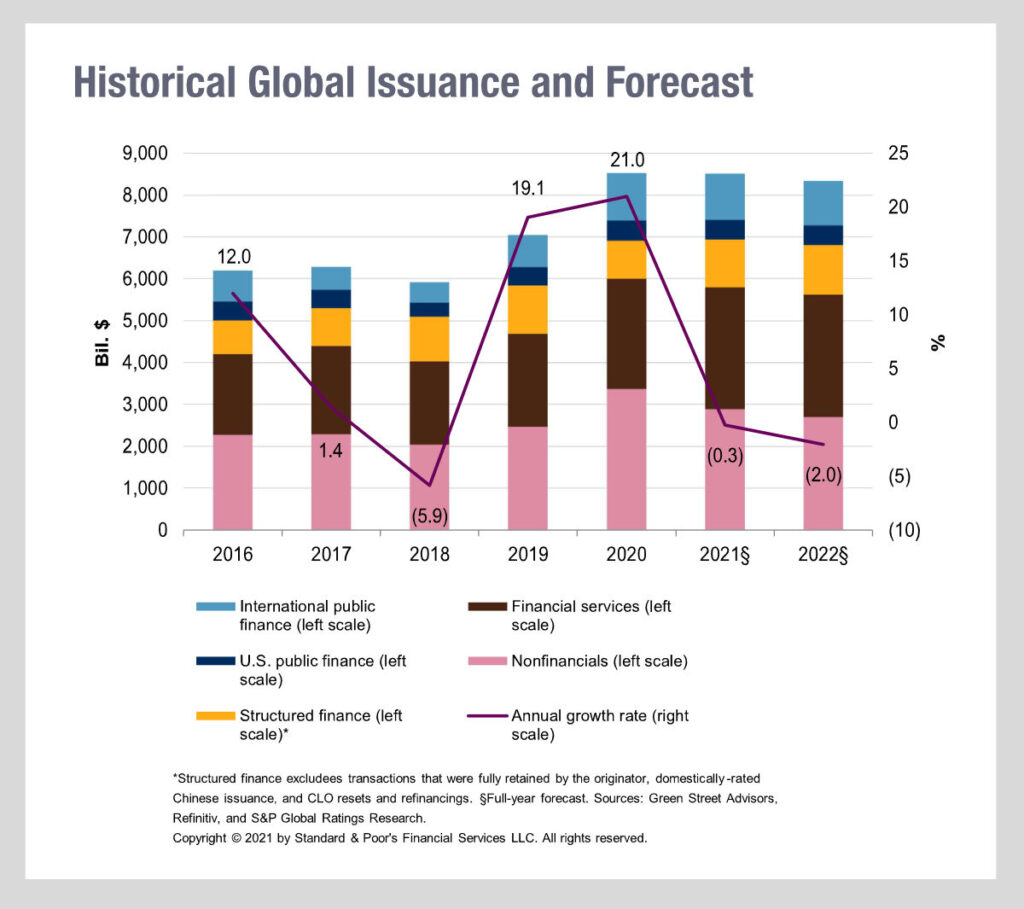

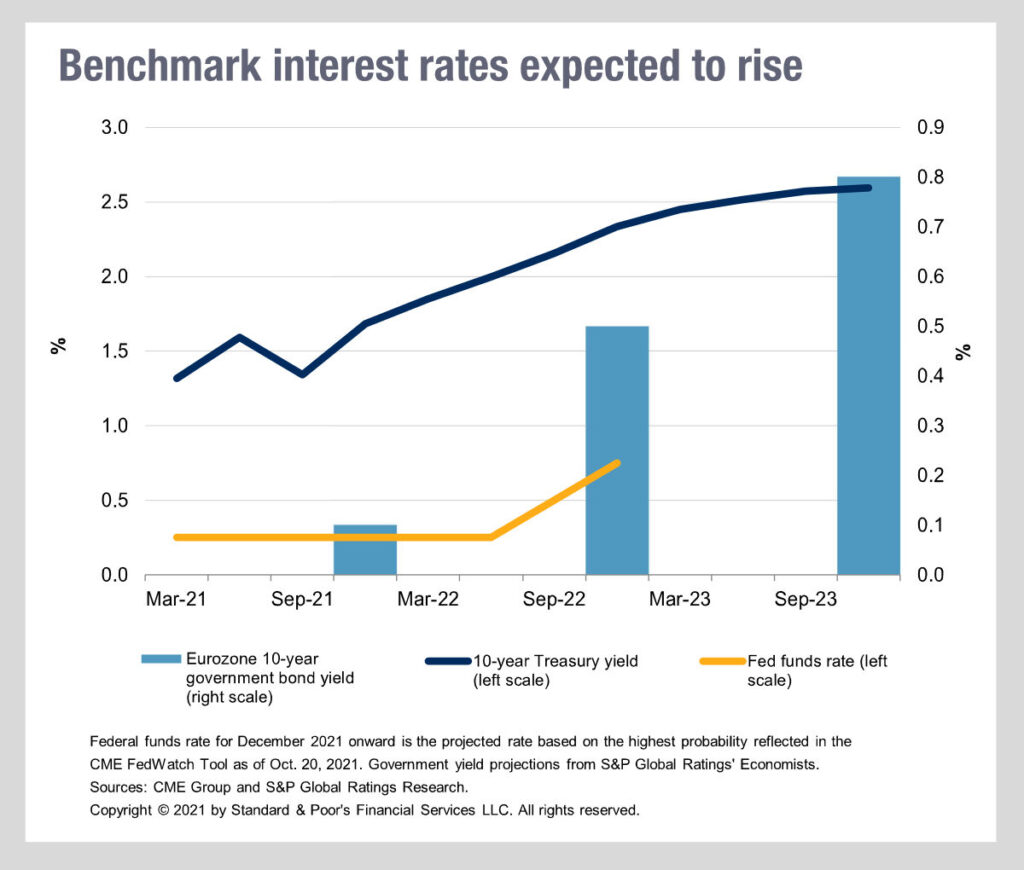

Despite the expectation of rising rates across markets, S&P Global Ratings Research are predicting that issuance of new bonds across markets will not see marked declines this year and into 2022.

The firm’s expectation across global markets is that 2021 will end on a par with 2020, a record year for new debt, falling just 0.3% with the previous 12 months. A 2% decline in 2022 reflects an expected drop in corporate issuance by non-financials, but will keep it above US$8.25 trillion.

Points to watch in the primary market space beyond rate rises are a drop in debt-fuelled M&A, China’s winding back of indebtedness and the impact of macro factors such as oil/gas prices and global tax changes.

The issuance of non-financial corporate debt is predicted to fall 14% in 2021 and another 7% in 2022. Investment grade (IG) credit has recently been the largest element of debt issuance, however financials are likely to overtake non-financials this year and next, up 10% this year, with a much smaller rise next.

Interestingly, given the concern credit derivatives were creating a decade ago, structured credit (SC) origination volume is up 146% in 2021 to the end of Q3 with leverage increasing significantly. S&P note that the leveraged loan market is approximately US$624 billion in 2021 so far, a record.

In total this spells a drop in new liquid assets, and more growth in less liquid over-the-counter markets. Primary markets will remain a key source of liquidity, but as packaged debt in the shape of collateralised loan (CLOs) and collateralised debt obligations (CDOs) is driven out to some investors, secondary market activity may prove more restrained.

©Markets Media Europe 2025