S&P Global Ratings has said it believes a high degree of unpredictability exists around policy implementation by the US administration and possible responses regarding tariffs.

This carries over to a potential effect on global “economies, supply chains, and credit conditions”.

As a result, it has warned that baseline forecasts carry a “significant” amount of uncertainty.

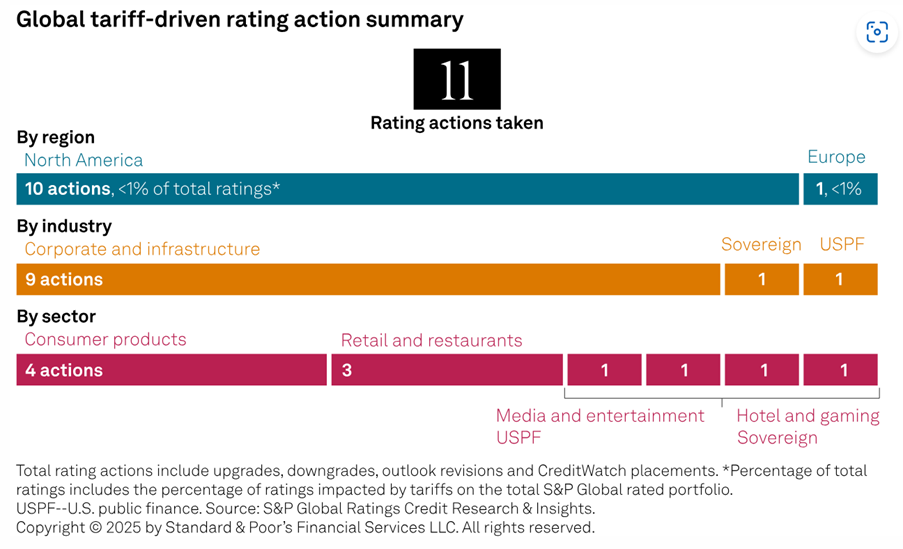

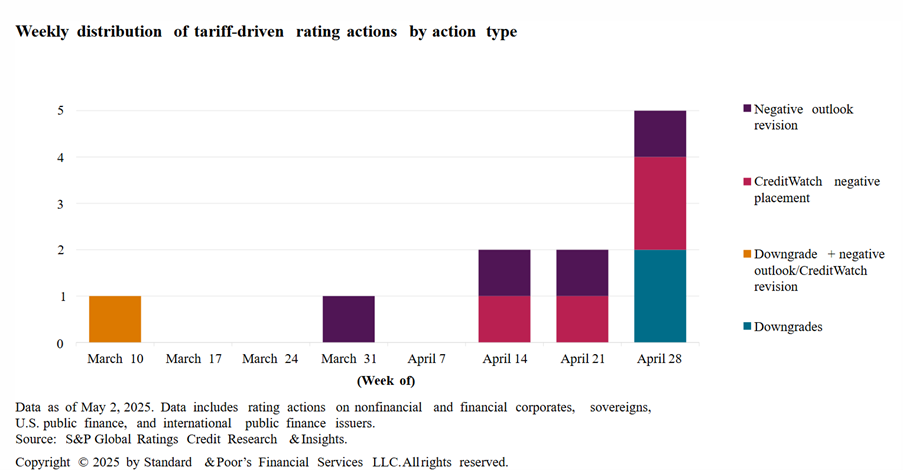

“As situations evolve, we will gauge the macro and credit materiality of potential and actual policy shifts and reassess our guidance accordingly,” the firm writes. To date these have included a number of downgrades in the week of 28 April.

It has published an assessment of the effect that tariffs will have on global trade, driven by increased interest from end investors and issuers.

“S&P Global Ratings is publishing a biweekly update of rating actions we have taken globally on nonfinancial and financial corporate, sovereign, US public finance, international public finance, and structured finance entities, as well as a summary table and supporting charts,” the firm notes. “These are public ratings in which 2025 tariff pronouncements are a primary driver of the action. Rating actions may include upgrades, downgrades, outlook revisions, and CreditWatch placements as of 2 May, 2025, unless stated otherwise.”

©Markets Media Europe 2025