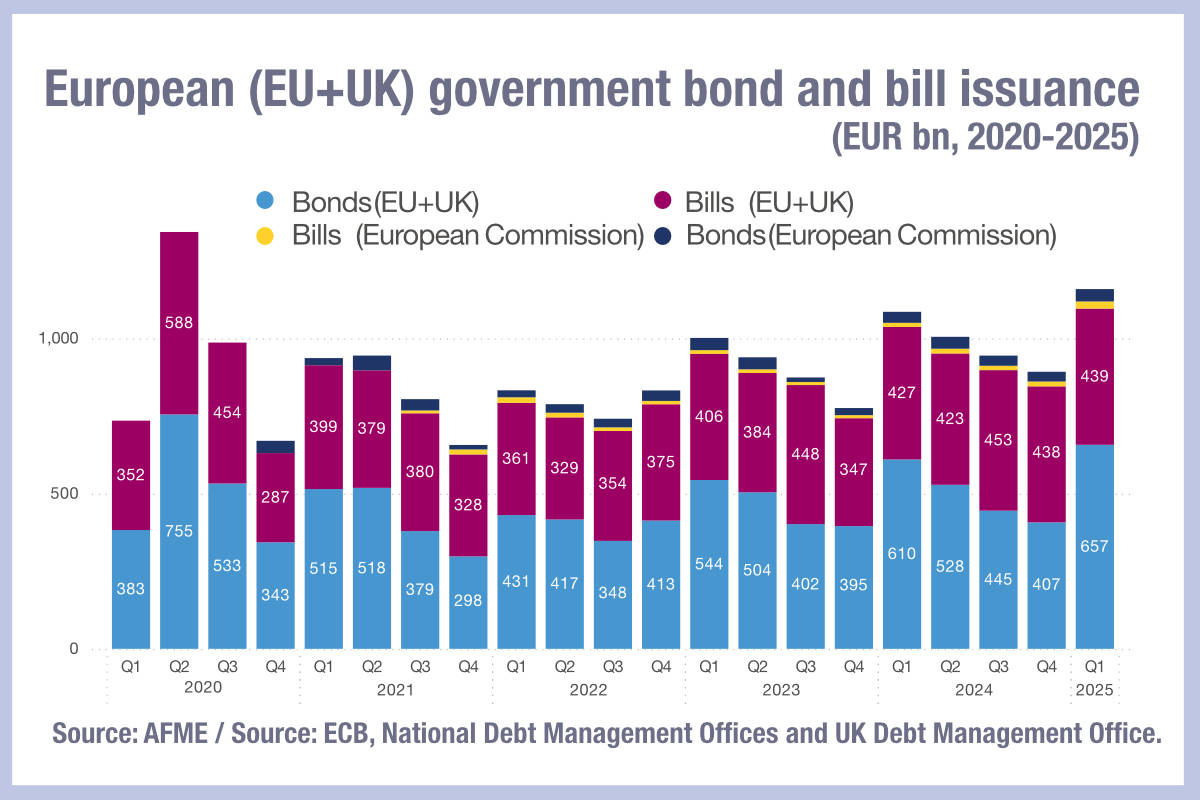

This year saw the highest first-quarter European government bonds and bills issuance volume since 2006 as €1.2 trillion was issued in Q1 2025, according to the Association for Financial Markets in Europe (AFME).

Total quarterly gross issuance in Europe, including European Union (EU) member states, UK and the EU Commission, was €1.159 trillion during Q1 2025, up 6.7% compared to year-on-year (YoY) Q1 2024 and up 29.8% quarter on quarter (QoQ) from Q4 2024. Total bond and bill issuance in Q1 2025 represents the highest first-quarter issuance on record – since 2006 – and the second-highest quarterly issuance overall after Q2 2020, according to AFME

Excluding institutional issuance from the EU Commission, both EU member states and the UK issued €1.1 trillion in bonds and bills during Q1 2025, representing a YoY increase of 5.7% and a QoQ increase of 29.6%.

The EU Commission issued an additional €40 billion in EU-bonds and €23 billion in EU-bills during Q1 2025, representing 5.4% of total European sovereign issuance, up from 5.3% in Q4 2024, and up from 4.5% in Q1 2024.

The UK continues to have significant funding requirements, with total quarterly bond and bill issuance increasing 25.2% YoY during Q1 2025 and representing 17.5% of total European (EU+UK) volumes, up from 14.7% in Q1 2024.

In its mid-year investment announcement, asset manager Amundi, which has €2.1 trillion in assets under management (AUM), noted that its expectation for steeper yield curves and rate volatility would favour a flexible approach to diversification from the US across global markets.

“We favour European and EM government bonds, which may benefit from a good growth and inflation mix and weaker USD, we are tactical on duration,” they noted. “In credit, we favour high-quality credit and prefer European over US investment-grade. We are neutral on high-yield as spreads may rise towards the end of the year. In terms of sectors, we like financials and subordinated credit. Bank subordinated debt could prove one of the most interesting segments.”

©Markets Media Europe 2025