The latest breakdown of debt capital market (DCM) issuance by Dealogic has found that deal numbers in the US have declined slightly year-to-date versus the same period in 2024, while net deal value has increased slightly.

This follows a significant fragmentation of deals after 2023, at which point the number of deals YTD had grown 59% in 12 months, while value increased by just 20%, having already fallen by 40% since 2020.

Consequently, in 2025 deal value is 24% below 202 levels YTD, but numbers are up 76%.

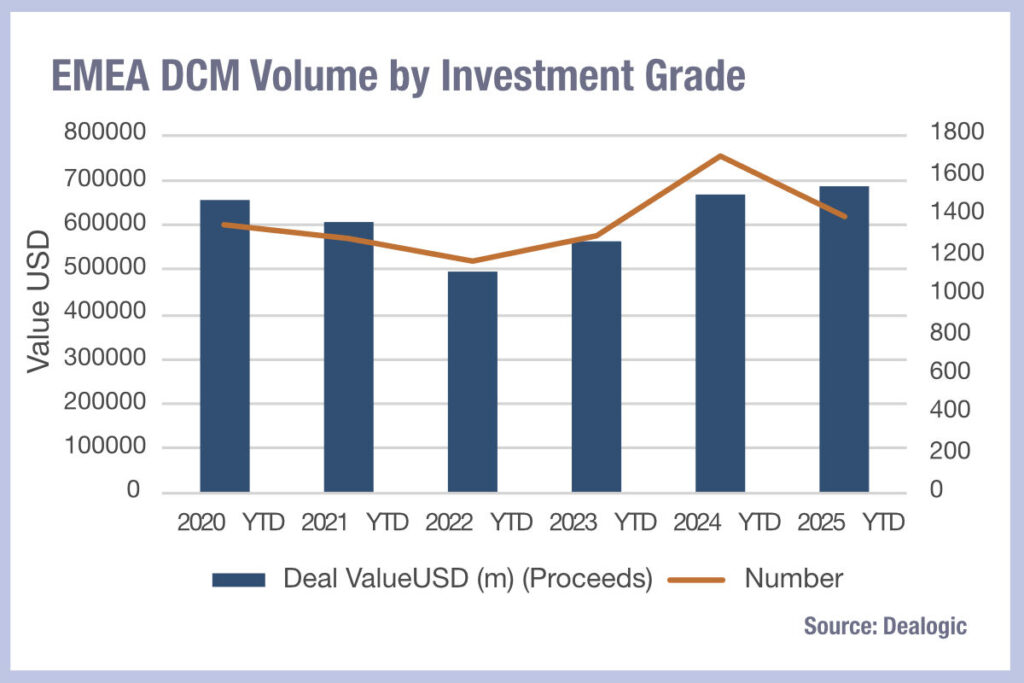

European, Middle Eastern and African (EMEA) DCM has been far less volatile, but is taking a different path. Dealogic finds that in 2025 YTD deal value is up 5% on the same period in 2020, while numbers are up just 2%.

The 3% rise in value and 18% drop in number YTD against 2024 points to a healthy level of debt issuance across a smaller number of deals and potentially means that there will be a polarisation of banks delivering a successful H1 2025 in capital markets, as a smaller number see better deal sizes year on year.

©Markets Media Europe 2025