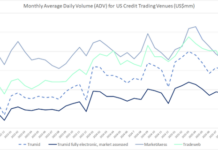

Tradeweb now narrowly leads over MarketAxess in fully electronic US IG+HY trading, Trumid said it continues to gain market share.

Average daily volume reported on FINRA’s TRACE tape for US investment grade (IG) and high yield (HY) bonds barely budged in July. US electronic credit average daily volume (ADV) across investment grade and high yield (IG and HY) reported on TRACE reached US$49.7 billion, down 0.2% month‑on‑month (MoM) from June’s US$49.8 billion and 15% higher than a year earlier. IG volumes plateaued at US$37.1 billion, flat MoM and up 9.8% YoY, while HY volumes eased to US$12.5 billion, falling 1% MoM but still 34% higher than July 2024.

Momentum was mixed across the main US electronic credit platforms. Aggregate electronic US credit ADV for the three venues in our dataset (Tradeweb, MarketAxess and Trumid) totalled US$22.1 billion, fractionally lower than June, as a sharp drop at MarketAxess offset gains at Trumid and marginal growth at Tradeweb.

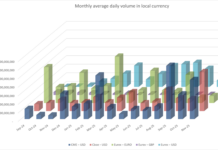

Tradeweb’s fully electronic US credit ADV held steady at US$8.1 billion in July, flat MoM and 21% higher than a year earlier. The platform’s investment grade activity grew marginally to US$7.13 billion, a 0.6% MoM increase and a 21.5% YoY rise. High‑yield volumes slipped to US$0.97 billion, dropping 2.8% MoM but remaining 17% above July 2024. European credit ADV climbed 12% MoM to US$2.8 billion, bringing year-on-year growth to 33 %. Tradeweb attributed the YoY gains to increased adoption of its portfolio trading (PT) and request for quote (RFQ) protocols and noted that cash credit portfolio trading grew by 35.8 % YoY.

MarketAxess reported a sharp deceleration in US electronic credit volumes from the prior month. US high-grade ADV dropped to US$6.39 billion, down 8.7% MoM but still 4.9% above July 2024. US high‑yield ADV fell 10% MoM to US$1.35 billion but remained 19.5% higher YoY. Emerging market and Eurobond trading also cooled, slipping 9.7% and 6% MoM, respectively, but both segments recorded double-digit YoY growth. Total credit ADV across MarketAxess (including EM and Eurobonds) was US$14.3 billion, down 8.4% MoM yet 12.1% higher YoY. The company said new initiatives across client initiated, portfolio‑trading and dealer initiated channels drove strong YoY growth; for example, block‑trading ADV rose 9 % YoY. The firm noted in its release that portfolio‑trading ADV jumped 32% YoY to US$1.3 billion.

Private venue Trumid reported the strongest sequential momentum among the big three. It reported average daily volume of US$6.3 billion, up 10.5% MoM (from US$5.7 billion in June) and 21.5% YoY. The firm said its list-based request for quote and portfolio‑trading protocols were key growth drivers, with combined ADV up 75 % YoY.

©Markets Media Europe 2025