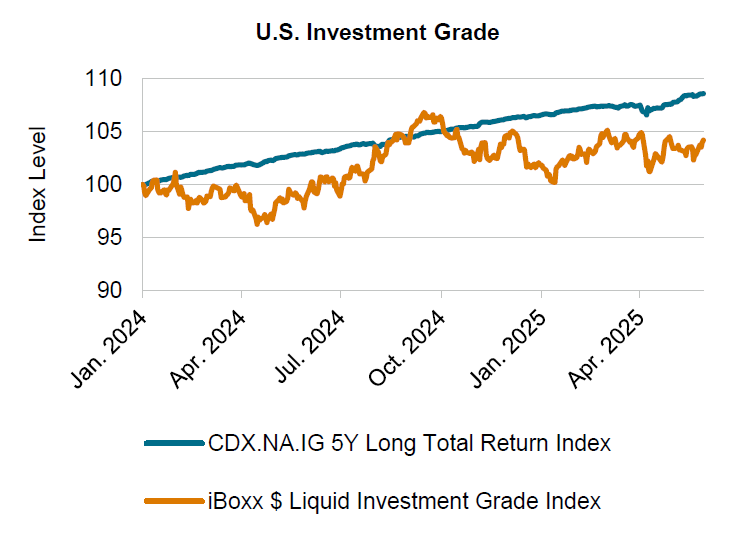

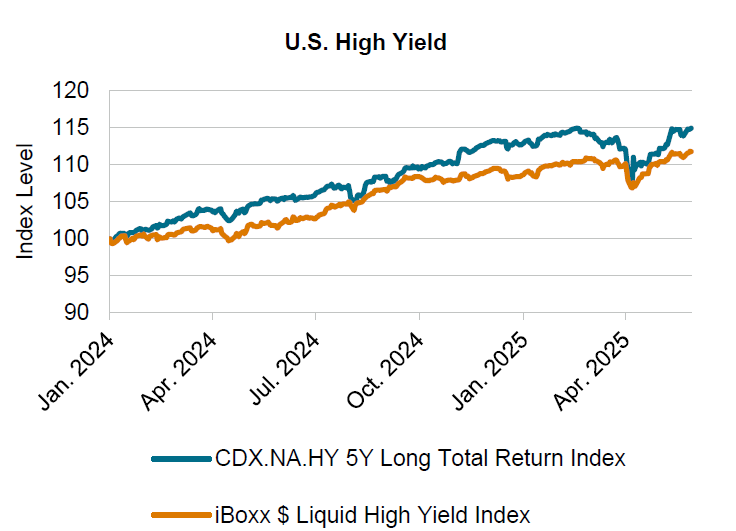

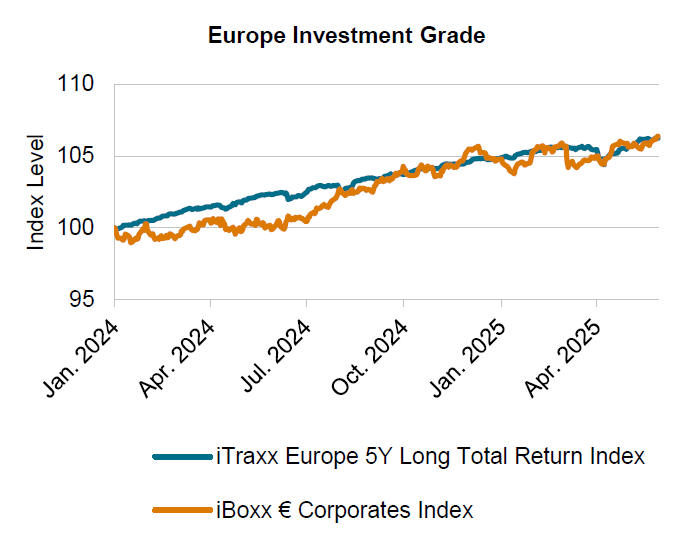

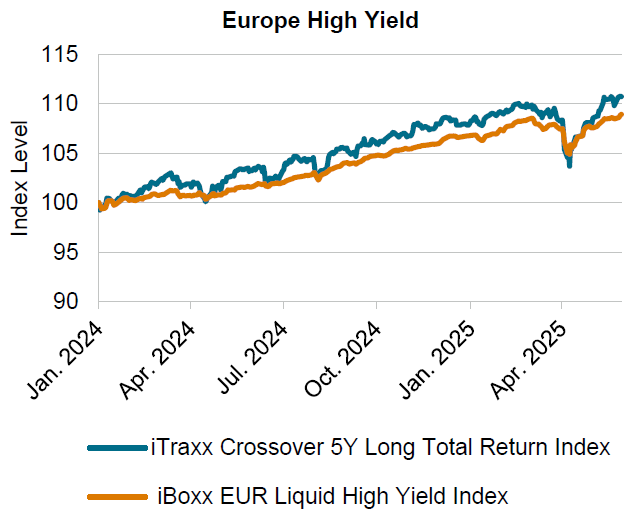

Analysis by S&P Global Market Intelligence charts the rise of credit markets over the past year, and finds index levels are by 10-15% of value in some cases.

Analysis by S&P Global Market Intelligence charts the rise of credit markets over the past year, and finds index levels are by 10-15% of value in some cases.

The risk in credit portfolios, and correspondingly for banks to carry credit trades, boomed in the first half of 2025 through a combination sudden on-off import tax rises in the US, alongside war and increasing diplomatic tensions. These blew out credit spreads and bid-ask spreads as risk increased.

“The CDX North America Investment Grade index reached 80 bps, and the CDX North America High Yield index spiked above 475 bps,” wrote S&P’s Nicholas Godec and Kai Aeberli. “This volatility surge catalysed exceptional trading activity across fixed income index products, with many segments posting record or near-record volumes, as market participants sought to adjust exposures and hedge credit risk more aggressively.”

At the same time, they noted. the iTraxx Europe index hit 112 bps and iTraxx Europe Crossover index up to nearly 430 bps.

Volumes for trading jumped across the board and although bid-ask spreads widened, the rebound on tariffs concerns was rapid, and bid-ask spreads tightened fairly quickly after the initial concern.

Equally, the value of credit indexes has continued to climb. In 2024, trading volumes of iTraxx and CDX products were slightly higher than in 2023, across US, APAC, Europe and EM markets, however they were still down on the highs of 2022.

Yet with values rising and average bid-ask spreads for induvial bonds tightening across credit markets, the ability to realise upside has become cheaper for buy-side traders and investors.

Although ETF and index product volumes may be lower than 2022, this may be a reflection of their use in the incredible volatility following Russia’s invasion of Ukraine that year.

The use of index products climbed in 2024 vs the previous year, and with the continuing rise of portfolio trading and electronic market makers in credit, it seems clear index levels and volumes will continue on their upward journey.

©Markets Media Europe 2025