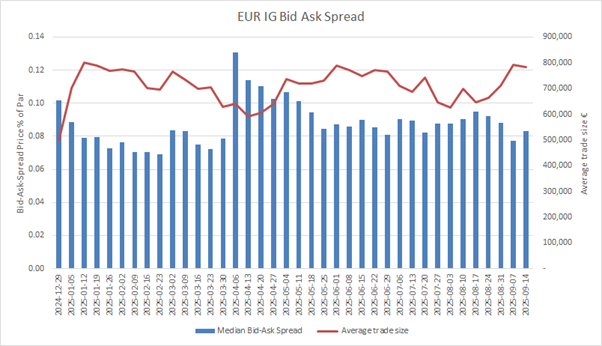

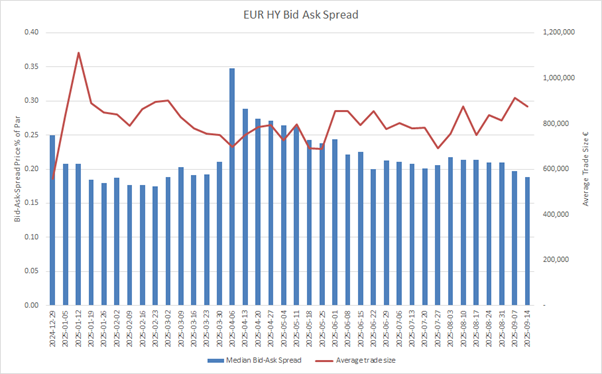

European bond traders are seeing average trade sizes expanding in September while bid ask spreads lower to the bottom end of their range as business truly bounces back after summer, according to data from MarketAxess TraX and CP+ data services.

The bumper issuance seen at the end of Q3 has helped deliver a boost to the traders, as liquidity increases commensurately with primary market activity, and that is no doubt supporting banks’ efforts to deliver larger sized trades. Although trade sizes are increasing, the falling bid-ask spreads indicate banks are comfortable offering balance sheet to their clients in order to take trades on risk.

Investment grade is seeing lower pick-up than high yield, likely tied to the quarter’s year-to-date issuance of IG being lower than the same period in 2024, and a drop off in secondary trading volumes in the last couple of weeks which would have collectively turned off the tap on liquidity supply.

High yield has seen bid-ask spreads tighten, very favourably for buy-side traders, which is likely to be tied to the outperformance of issuance in the third quarter of 2025, relative to the same period in 2024, and very steep growth in both trade count and volume.

These may also reflect the growing comfort that trading desks have with larger sized electronic trades, are new protocols evolve allowing blocks to be traded with lower levels of information leakage than request for quote (RFQ) approaches.

Heading into Q4 for 2025 this bodes well for buy-side traders accessing European high yield debt.

©Markets Media Europe 2025