The latest Bank of America ‘European Fund Manager Survey’ has found that investor confidence has returned as stronger growth and sticky inflation creates a ‘higher-for-longer’ macro backdrop for markets.

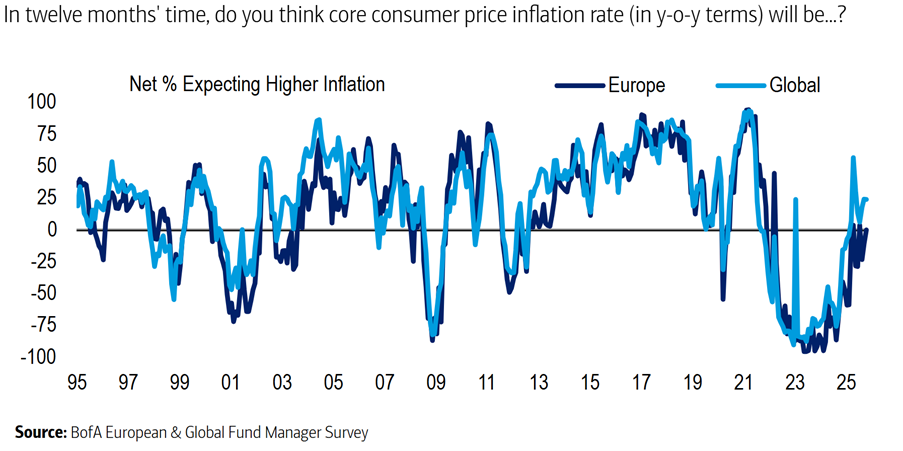

The picture for inflation has moved slightly higher with nearly a quarter (24%) of global investors surveyed expecting higher core inflation globally over the coming twelve months, unchanged from the results in the previous month, while none now expect lower core inflation in Europe down from 11% last month.

The share of respondents citing concern about moving out of equities too early or by too much, thereby missing out on a rally, increased to 36%.

The ‘AI bubble’ is now the primary market tail risk investors are worried about, but not enough to to quash the rosy overall outlook. The survey also found that investors were far more sanguine about the political associated with US equivocation on policy.

“The Trump administration’s policy mix has slipped to the #2 downside risk for global growth after being #1 for most of this year, while the trade war triggering a global recession is seen as the biggest market tail risk by only 5% of respondents (#6 on the list), compared to nearly 40% of respondents back in July (#1 on the list),” the report found. “This fading concern (with the survey conducted ahead of the renewed flare-up in US-China tensions last week), alongside growing expectations of monetary easing (#1 upside risk for global growth) has led to increased confidence on the macro outlook. Soft landing remains the majority view on global growth, but the no-landing camp has increased to the largest since February (33% of respondents), while global recession expectations have fallen to the lowest level since 2022.”

©Markets Media Europe 2025