US life insurer, Brighthouse Financial, was downgraded by ratings agency Fitch on Monday, following the announcement it was to be acquired by private investment firm Aquarian Capital LLC, which has a lower credit rating than Brighthouse. This downgrade is emblematic of an increasing exposure to worsening credit ratings via investment in private credit and equity, and ownership by less regulated private equity companies.

Brighthouse Financial’s Issuer Default Rating (IDR) dropped to ‘BBB’ from ‘BBB+’, and the Insurer Financial Strength (IFS) ratings of Brighthouse Life Insurance Company and New England Life Insurance Company fell to ‘A-‘ from ‘A’.

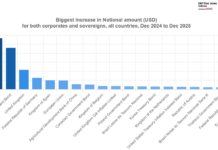

The US life and health insurance sector saw more downgrades than upgrades in 2024, according to ratings agency AM Best, while the sector continued to see investment from, and into private market funds.

The private acquisition of insurers, and subsequent direction of their investment portfolios into other private assets was flagged as a potential systematic concern in the 2023 Global Financial Stability Note published by the International Monetary Fund (IMF), entitled ‘Private Equity and Life Insurers’, and remains an issue two years later.

“Private equity (PE) firms have increasingly partnered with or acquired insurers,” noted the Bank of International Settlement in its October 2025 paper, ‘The transformation of the life insurance industry’.

“Such insurers have been more likely to rebalance their portfolios towards higher-risk investments, such as structured products, affiliated assets and riskier mortgages, and to more complex reinsurance structures,” it noted. “Asset-intensive reinsurance (AIR), particularly with offshore reinsurers, has become a key strategy for capital management. At the same time, the growing influence of PE investors has also created governance challenges.”

Fitch said it expects Aquarian to manage Brighthouse’s investment portfolio and to add incremental illiquidity and complexity to it while increasingly using reinsurance to reduce risk and free up capital.

Although private equity and credit may not be considered a systemic concern, private equity firms actually contain public capital, with between 15-20% of assets in US pension funds attributed to private market investments in 2023 by multiple analyst firms. Their private nature means the standards for rating quality and disclosure are far less transparent than for public funds or assets.

S&P Global Market Intelligence found in Q1 2025 that of 298 pension funds it tracked, 174 had an overallocation to private equity, with California State Teachers’ Retirement System (CalSTRS) the largest overallocation among pension funds, at US$7.49 billion of a total $53.88 billion, while the California Public Employees’ Retirement System (CalPERS) recorded the largest private equity allocation at US$90.37 billion. Consequently, the impact of losses in private investment will have an impact on savers

Private equity firms are also under strain to deliver promised returns on their investments, and increasingly struggle to exit investments profitably, with S&P Global Market Intelligence reporting that negotiated exits – with terms typically unfavourable to the PE firms – are at record levels. Yale Daily News reported in June 2025 that the Yale Endowment Fund, a leader in private equity investments, was selling some of its private equity investments in the secondary market for the first time, and at a slight discount.

In fact, a 2024 report found that US insurers experienced a second straight year of declining income on their private equity investments, which dropped to $7.7 billion in 2023, down from $10.2 billion in 2022, according to AM Best, while their private equity holdings rose 10.8% to US$146.2 billion, up from US$132 billion in 2022, with PE investments concentrated in a few large insurers, almost entirely life and accident companies accounting for just over 60% of private equity holdings, with allocations averaging 5% of invested assets.

This does not appear to have dissuaded them. Goldman Sachs Asset Management’s 2025 Global Insurance Survey found insurers expect to increase their allocations to private credit – typically of a junk level credit rating or below – and private equity, and increase their exposure to credit and liquidity risk.

In a low – and falling – interest rate environment, life insurers are using private investment sleeves to increase exposure to higher risk credit and equity, all of which lacks a liquid secondary market which would enable a more orderly risk transfer in the event their risk profile changes.

©Markets Media Europe 2025