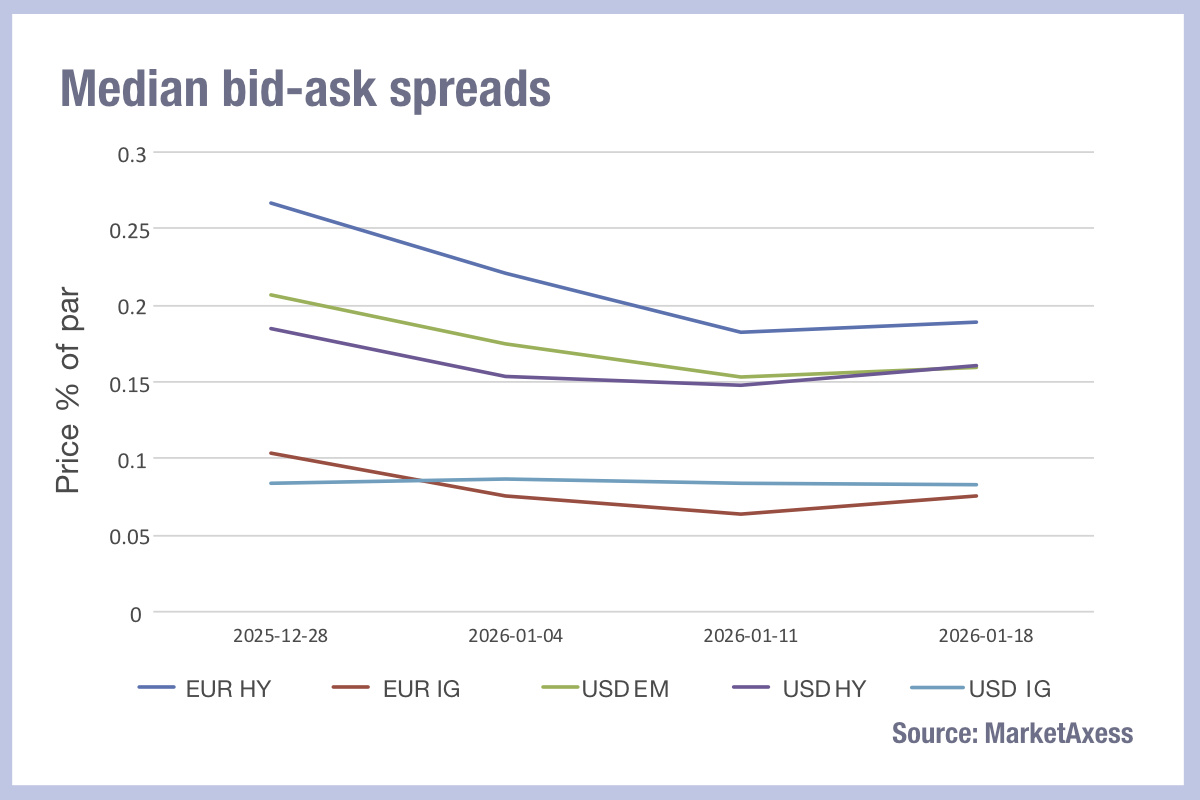

The rigid grip on safer assets that investors have taken over the past two weeks has clearly shown in trading costs as bid-ask spreads begin to widen in credit markets, according to MarketAxess data.

The drop off in explicit trading costs that normally occurs at the start of the year, is often driven by the liquidity reservoir created by high levels of newly issued bonds.

This year, while gold prices have rocketed, supported by the falling dollar, median bid-ask spreads in corporate bond trading have begun to widen. Trading volumes and counts also dipped as new issue levels fell later into the month.

Collectively this points to an increasing cost of liquidity matched by falling activity, and therefore a more expensive, less liquid market to trade for buy-side desks.

The consistent bounce upward in bid-ask spread width across geographies and currencies, with only US investment grade remaining flat, suggests that there is a macro trigger to the bounce.

This could be a combination of the heightened risk concerns around US foreign policy following the threat to use force to acquire Greenland, and the ongoing uncertainty regarding Ukraine. Dealers reducing risk capacity would increase trading costs for clients.

It may also be a reflection of the sell-off in Japanese government bonds as yields rose rapidly, with Japanese holders of US Treasuries facing the potential to swap dollar assets for Yen-denominated assets to reduce currency risk.

For buy-side trading desks who are already burdened with a very active new issue calendar, getting ahead of increased trading costs will require a clear pre-trade picture, in order to pick up opportunities in the secondary market at a fair price and without increasing implicit trading costs by having to cast out wide into the market to source counterparties.

Bond market data today has the necessary quality and quantity in more liquid markets, such as US IG, to limit the effects of macro impacts on trading costs, by mitigating liquidity risk. It is also available, but perhaps harder to source, in other markets such as European IG, high yield and emerging markets (EM). Trading desks finding tighter bid-ask spreads will be those who can source the better data.

©Markets Media Europe 2025