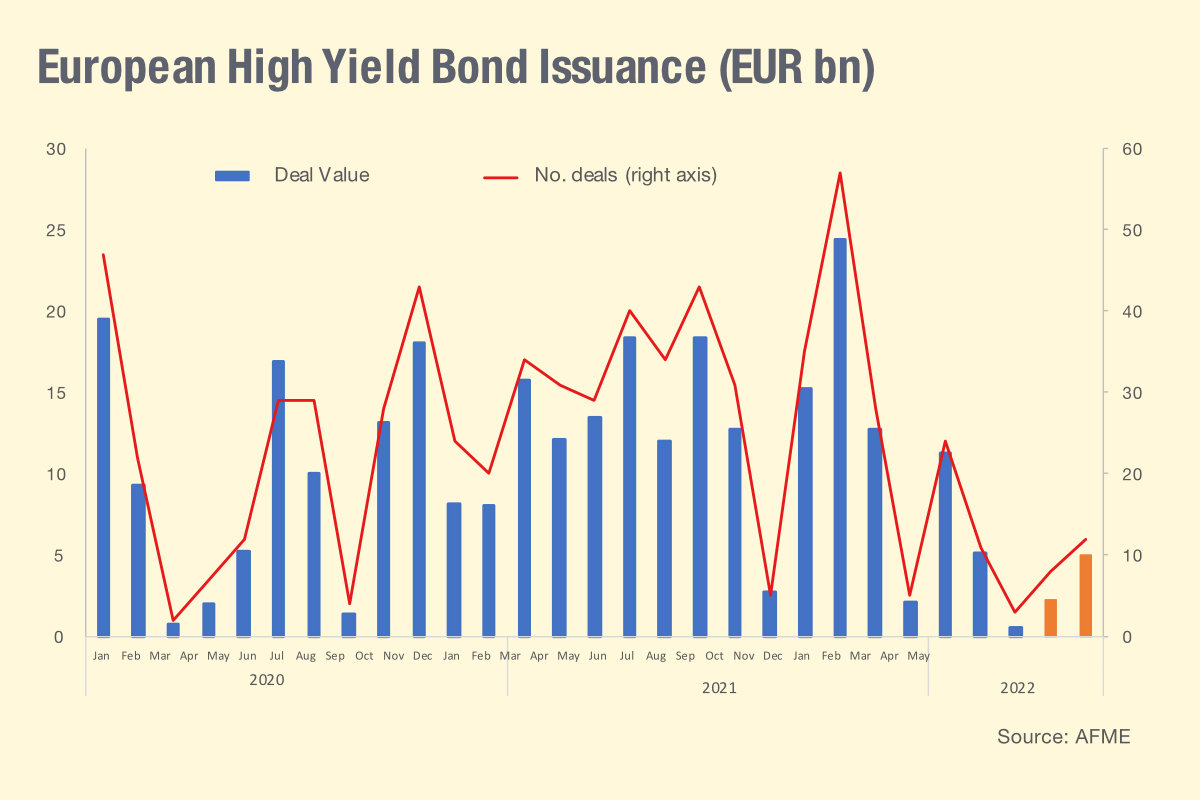

A new report by AFME found that the primary high yield bond market decelerated significantly in Europe at the start of this year.

High yield (HY) bond issuance in Q1 2022 totalled €16.9 billion on 38 deals, a 57.4% decrease from €39.3 billion on 90 deals in Q4 2021 and a 59.3% decrease from €41.3 billion on 94 deals in Q1 2021, according to the ‘High Yield and Leveraged Loan Data Report’ from AFME.

The proportion of USD-denominated issuance decreased to 22.3% of all issuance in Q1 2022, down from 28.8% in Q4 2021 but up from 17.2% in Q1 2021.

AFME reports that the leading use of proceeds for high yield bond issuance in Q1 2022 was refinancing/repayment of debt, at €7.3 billion, which was higher than €6.4 billion in Q4 2021 and than the €3.2 billion in Q1 2021.

More recent primary markets activity data from Dealogic as of end May 2022 found that the issuance of high yield bonds has recently improved although volumes continue below the monthly amounts observed at the end of 2021.

©Markets Media Europe 2025