By TheDESK

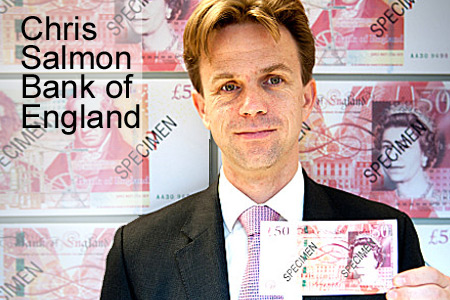

Chris Salmon, executive director for markets at the Bank of England has warned that risk management techniques need to develop to handle the movement from voice and over-the-counter (OTC) trading toward electronic execution, and specifically the interconnectedness of banks.

In a speech at the Annual Central Bank Conference on the Microstructure of Financial Markets on 6 October 2016, Salmon observed that flash crashes were likely to be just one symptom of these material changes in the structure of markets and the make-up of market participants.

Salmon warned risks can exist through indirect as well as direct exposure to developments in fast markets, for example by using exchange-traded instruments like government bond futures and/or exchange-traded funds (ETFs) exposes firms indirectly to less liquid underlying ‘slower market’ instruments.

A future stress in fast markets, such as for ETFs, could persist.

“It might spill over to cause stress in other linked markets, including for less liquid underlying instruments, including government or corporate bonds as well as equities, leading to wider implications for financial stability,” Salmon warned.

©TheDESK 2017

©Markets Media Europe 2025