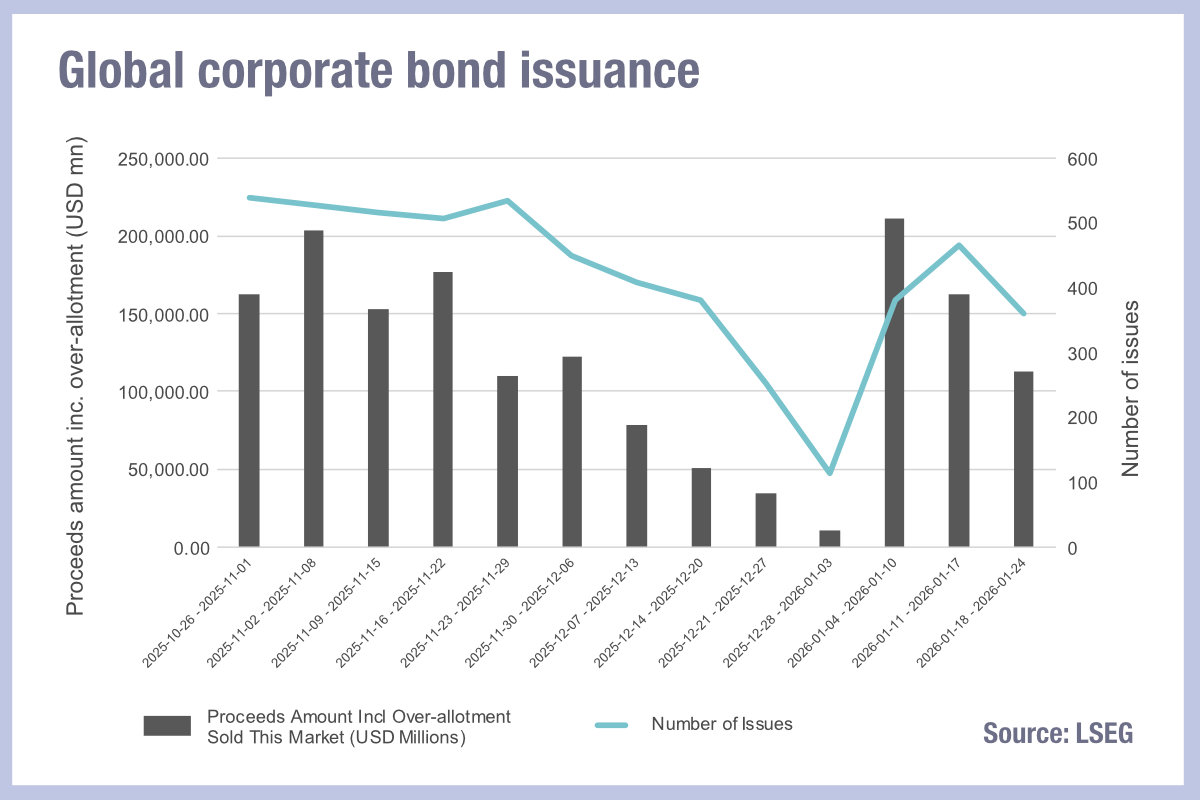

Corporate bond issuance started the year hot, with over US$211 billion issued globally in the week beginning 4 January, however numbers dropped off pretty fast, relative to recent months, according to LSEG data.

Year-to-date the market has seen US$500 billion of bond corporate bonds issued, but that was US$195 billion shy of the first four weeks in November 2025, which saw over US$800 billion of credit issued by month end.

Some big European issuers, such as French telco Orange, issued dollar debt potentially reaping the rewards of the declining dollar against other currencies, and that opportunity may prove to be a catalyst for others to issue earlier in the year, dependent on dollar value expectations.

“The US remains the cheapest market to issue in, and we have seen a notable shift of European corporates tapping USD markets over the past three weeks, particularly across ‘Autos’ and ‘Banks’,” wrote UBS strategist, Julien Conzano, in a report issued 27 January 2026. “We expect this trend to persist, potentially accelerating if the US Federal Reserve delivers the cuts currently priced.”

UBS is expecting US$1.7 trillion of US investment grade (IG) issuance this year, against €750 billion of European IG, meaning the latter is softening whilst the former should hit another record.

High yield (HY) primary markets are expected by the bank to reach US$365 billion and €95 billion in Europe.

While tech is tabled to be a major source of new debt, alarm bells that began ringing last year persist into 2026, with caution around levels of leverage found in some firms who are perceived to be exposed to fixed costs for development against more speculative levels of income from that investment.

“Despite heightened equity volatility around AI, credit markets have shown limited dispersion in hyperscaler bond performance, while remaining very sensitive to issuers that materially re-levered as illustrated by Oracle’s notable underperformance in 2025,” writes Conzano. “Looking ahead, we think investors should focus less on picking winners and more on avoiding AI ‘beneficiaries’ with weak or negative FCF/Capex profiles and already elevated Net Debt/EBITDA levels.”

©Markets Media Europe 2025