The rising rate environment has increased interest in fixed income exposure amongst end investors.

In the US, The DESK has met with several fund managers who are responding with new fund launches, or rebalancing portfolios more in favour of fixed income assets. However, getting access to decent liquidity at this point can be a challenge. When assets under management are relatively small, and the investment strategy is a traditional long-only approach, getting brokers to engage with the firm can be hard.

Trading volumes are not likely to look exciting to a broker-dealers. Moreover, ticket sizes will often be odd lots. Banks have had a tough time making money in the fixed income space in recent years, hurting their capacity to intermediate credit markets. Capital rules are increasing their cost to trade risk assets and that makes parts of the credit market, notably high yield (HY), look less enticing to trade and drive.

Trading volumes are not likely to look exciting to a broker-dealers. Moreover, ticket sizes will often be odd lots. Banks have had a tough time making money in the fixed income space in recent years, hurting their capacity to intermediate credit markets. Capital rules are increasing their cost to trade risk assets and that makes parts of the credit market, notably high yield (HY), look less enticing to trade and drive.

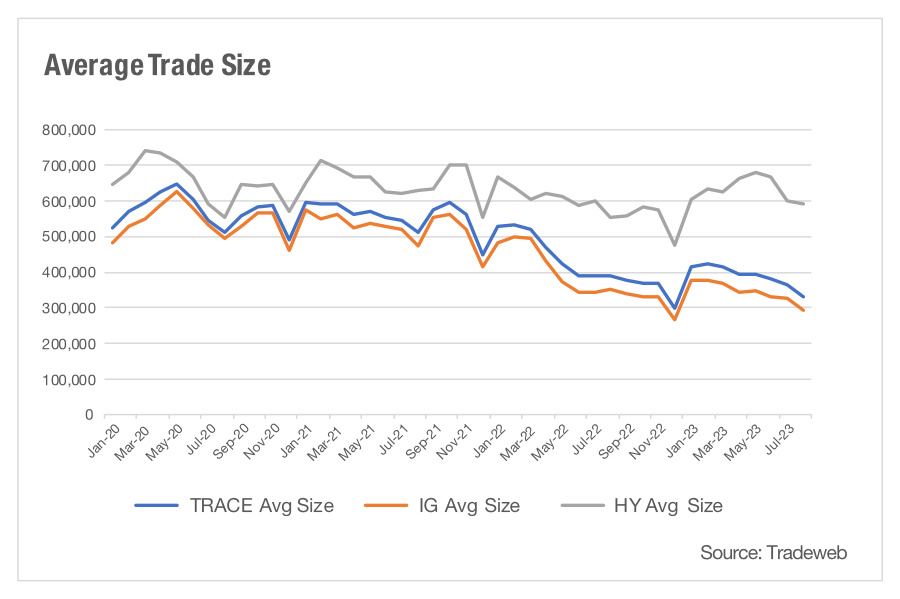

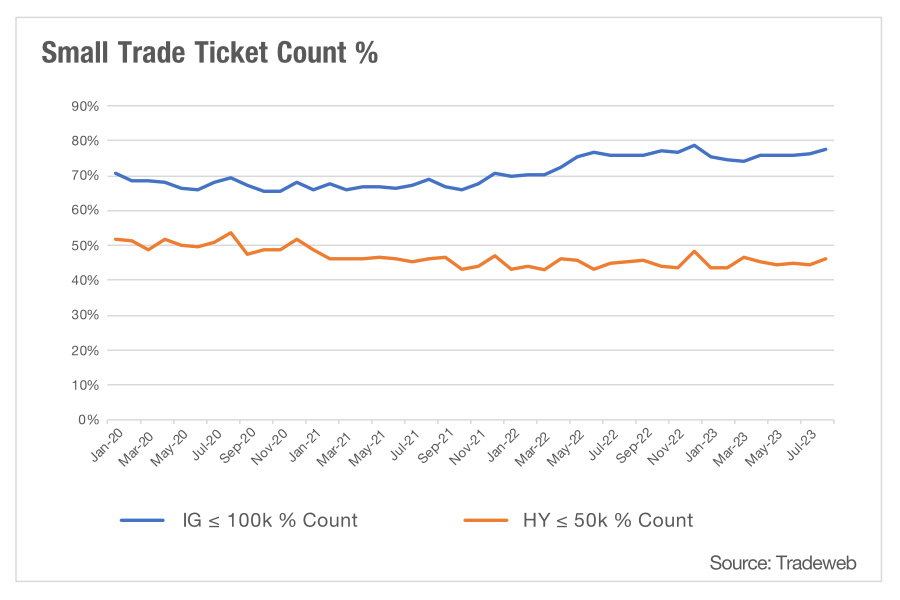

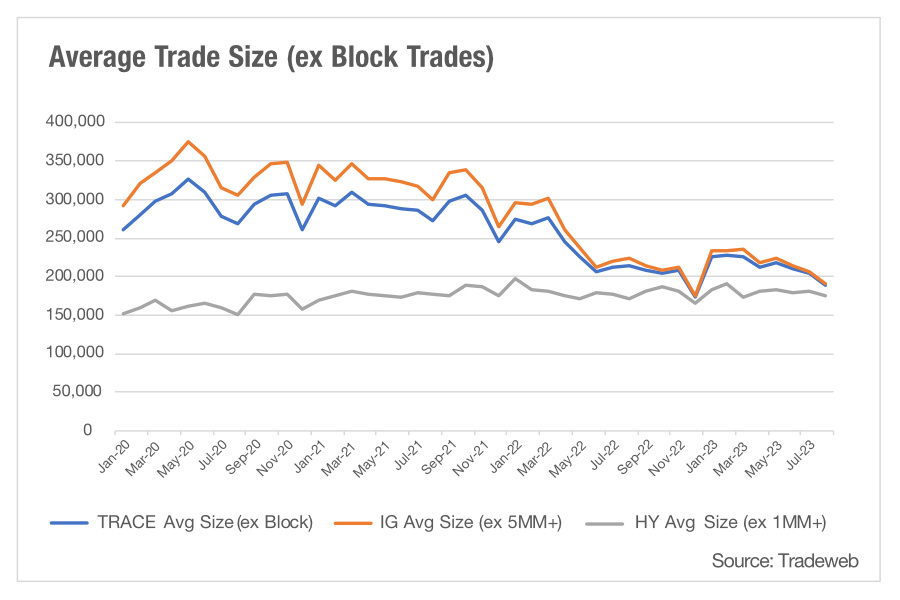

Analysis by Tradeweb has identified that small ticket count – sub US$50k in high yield – in the US is falling. For investment grade (IG) where small trades are classed as sub US$100k, the opposite is true. Comparing average trade sizes across both IG and HY the analysis indicates that IG has fallen to US$291k in August 2023 from US$495k in August 2020, while HY has risen to US$593k from US$533k over the same period. This divergence is making it harder to trade HY in smaller sizes and adding to the difficulty for these new entrants and smaller funds.

Analysis by Tradeweb has identified that small ticket count – sub US$50k in high yield – in the US is falling. For investment grade (IG) where small trades are classed as sub US$100k, the opposite is true. Comparing average trade sizes across both IG and HY the analysis indicates that IG has fallen to US$291k in August 2023 from US$495k in August 2020, while HY has risen to US$593k from US$533k over the same period. This divergence is making it harder to trade HY in smaller sizes and adding to the difficulty for these new entrants and smaller funds.

Price formation is harder for a desk that rarely trades, and that adds to the risk of poor execution quality, alongside the existing challenges of having trades on the blotter for extended period of time if liquidity cannot be found. The solution, proposed by several more experienced buy-side bond traders, is to put it all on electronic trading platforms. “Dealers will push out odd lots on platforms to get rid of them, they don’t want to spend time on the phone,” noted one.

Others point to the challenge of building and managing a dealer list for relatively small activity compared with getting access to a mix of disclosed and anonymous liquidity on e-trading platforms. Tying up a buy-side trader’s time executing small tickets with wide bid-ask spreads will push up the costs of trading even further.

Smaller teams are more likely to have the portfolio manager also functioning as the trader, so that time is not only sapping the quality of trading, but the whole investment process.

E-trading platforms can also support further processes – reporting, trade analysis – which improve the efficiency of the investment team. “It’s the most efficient way to tackle it,” added another trader.

©Markets Media Europe 2023

©Markets Media Europe 2025