Visualising the cost of credit trading cut in half since 2023

Credit markets have seen bid-ask spreads, a proxy for trading costs for the buy-side, tighten further in the first two weeks of 2026, relative...

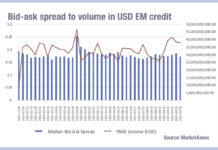

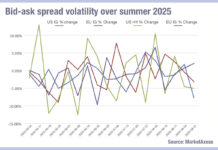

Bid-ask spread volatility highest in US bond markets

When comparing liquidity across markets in 2025, buy-side bond traders may consider European investment grade markets to have an optimal set of characteristics. However,...

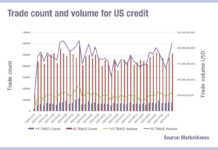

US credit activity dropped off a cliff in late November

Analysis of US corporate bond market activity has found that trading volumes and counts plummeted going into the final month of the year. A...

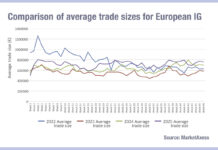

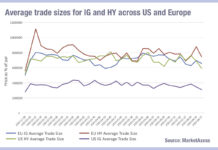

Credit trades’ double-figure yearly growth proves liquidity dividend

The gradual growth in trade sizes for European corporate bond trades is made clear in the latest MarketAxess TraX data comparison for data from...

Trade size disparity in US credit speaks volumes about balance sheet

Analysis of trading activity in the US corporate bond market shows that investment grade (IG) bonds are seeing greater moves towards larger order sizes...

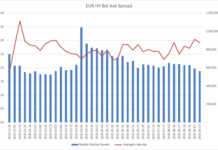

Bid-ask spreads expanding in European credit

European credit traders have seen bid-ask spreads expand over the past two weeks, however this follows a notable tightening since summer, according to data...

What’s up EM?

Emerging market volumes have jumped in September, hitting levels not seen since April 2025, when the US trade taxes on imported goods from every...

High yield market makers comfortable with risk

European bond traders are seeing average trade sizes expanding in September while bid ask spreads lower to the bottom end of their range as...

Price volatility in credit

We saw a big drop in average bid-ask spreads (>7%) for US investment grade (IG) last week, possibly a response to the massive levels...

Analysing the split between US and EU investment grade trade sizes

Recent reports that high yield (HY) trades are increasing in size and investment grade (IG) are shrinking, have ignored the year-on-year growth of European...