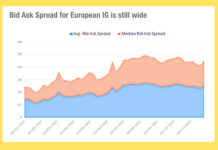

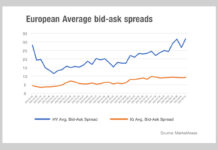

The cost of European liquidity is falling, does e-trading beckon?

Good news for buy-side traders in European credit markets. Looking at MarketAxess Trax, which tracks trading across multiple markets and counterparties, bid-ask spreads are...

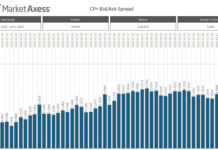

US Credit: Liquidity costs trending down

The bid-ask spread in US high yield trading is falling again having suffered an uptick in December, according to MarketAxess Trax, which tracks trading...

Same trading costs, different year

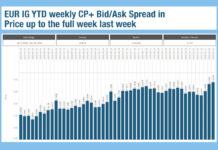

The new year has seen trading volumes drop back to a similar level as seen in early January 2022, but in European credit, bid-ask...

Reviewing 2022: European credit trading costs have doubled

There have been an enormous number of factors shaking up bond trading this year. From fixed income fundamentals like rapidly rising interest rates from...

All I want for Christmas, is trading analytics

Traders would do well to run close analysis over their European trading activity this month, as data from MarketAxess Trax, which tracks trading across...

Illiquidity creeps up in US credit… will e-trading save the day?

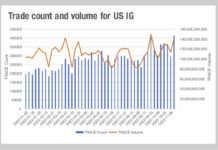

Looking at data on US credit markets, taken from MarketAxess Trax, which tracks trading across multiple markets and counterparties, investment grade trading volumes have been...

Breaking blocks

Electronic trading is certainly on a growth spurt – Coalition Greenwich reports e-trading was 46% volume across all assets in 2021 – but this...

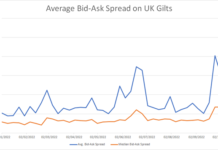

Barnes on Bonds: Secondary Gilt Trip

To look at the whipsaw effect of the UK’s 23 September mini-budget on secondary UK bond trading, we have taken data from MarketAxess TraX,...

What volatility looks like

Understanding how challenging the European markets have been to trade this year is far clearer when looking at the numbers. According to MarketAxess TraX...

Is a liquidity crisis brewing in European HY?

Concern around liquidity in Europe’s high yield market has been rising over the past quarter as it is hit by a double whammy, falling...