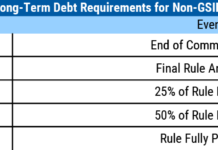

FDIC drive to issue US bank debt

Banks in the US have been asked by Government agencies to issue new debt to support their stability under a new proposal by the...

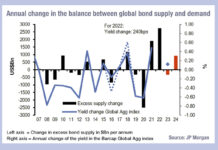

Rising rates but falling demand

Analysis by JP Morgan’s Global Markets Strategy team, Nikos Panigirtzoglou, Mika Inkinen and Mayur Yeole has cast an interesting light on the prospects for...

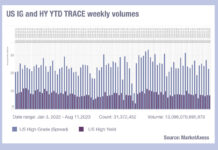

Seize the opportunity to apply AI in quieter bond markets

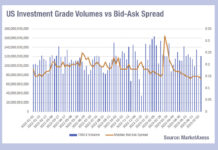

Secondary credit trading is seeing lower volumes as expected in the summer months, whilst bid-ask spreads have plateaued across Europe and the US markets,...

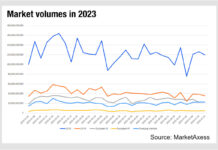

Local currency emerging market trading grows at MarketAxess

MarketAxess, the operator of an electronic trading platform for fixed-income securities, has seen a rise in volumes of local currency bond trading in emerging...

The summer lull barely touches emerging markets

Trading volumes in fixed income markets typically start the year high and gradually fall, matching issuance and refinancing patterns along with investment allocation decisions....

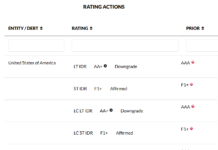

The US: Too big to Fitch?

Ratings agency Fitch has downgraded the United States’ long-term credit ratings to AA+ from AAA and removed the rating ‘Watch Negative’ stating “ reflects...

Implied cost of liquidity falling, with US high yield an exception

Volumes in the corporate bond markets have been picking back up, relative to bid-ask spreads, indicating an improving liquidity picture across the US and...

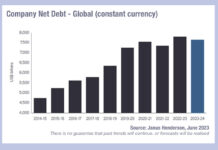

Issuance pushes outstanding global debt up 6.2%

Companies around the world took on US$456 billion of net new debt in 2022/23, as of 31 March 2023, pushing the outstanding total up...

ICMA fills in the blanks on MiFID II agreement

A new article written by the regulatory team at the International Capital Markets Association (ICMA), has shed light on details in the agreed text...

EM stabilising could encourage market makers

Emerging market activity has seen a reduction in volatility in the first half of the year, with both volumes and pricing levels falling slightly,...