The effect of war on pricing and spreads is widening

The economic effect of the Russian invasion of Ukraine needs to be put in context next to the human tragedy, but data is showing...

Juggling the growth in CUSIPs

If the population of a country increased by 50% since 2014, you would think a housing crisis was likely.

Yet in the year The DESK...

BIS: Cut your trading costs in half by cosying up to dealers

A new working paper, written by the Monetary and Economic Department of the Bank of International Settlements, has found that dealer relationships are crucial...

Tradeweb and MarketAxess see credit volumes increase over 25% in December

Market operators MarketAxess and Tradeweb have released their December trading levels, with both seeing a monthly increase of 25% in credit trading average daily...

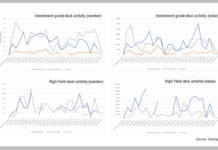

Competition for debt issuance fierce as activity remains

Primary debt markets are likely to be a major revenue earner for dealers facing tighter margins in secondary bond markets. Issuance has started strongly...

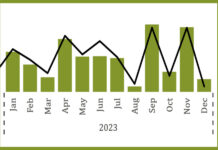

High yield bond issuance relative to liquidity

A report by the Association for Financial Markets in Europe (AFME) has found that primary issuance of European high yield (HY) bonds in 2023...

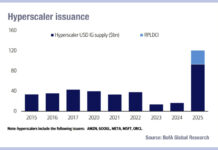

BofA: deluge of hyperscaler issuance steady at US$100bn in 2026

According to Yuri Seliger and Sohyun Marie Lee, credit strategists at Bank of America, in a note published on 17 November, the total of...

Aligning issuance and recession risk

Data from Dealogic is indicating highly variable bond issuance patterns in the US, European Union and UK markets, year-to-date.

This is understandable given the rapidly...

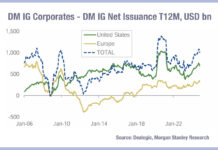

Primary held in check by tariff and rate uncertainty

Gross credit issuance has fallen in developed markets, according to data from Dealogic and Morgan Stanley, across investment grade (IG) and high yield (HY).

DM...

Invesco’s 2023 Fixed income outlook: ‘A promising year after a painful selloff’

Invesco has published its outlook for fixed income markets in 2023, noting that valuations now look more attractive, and yields are higher than they...