Timing is everything in the markets, but not every market shares the same timing. It is common for trading desks to employ a trader to work in overseas markets by getting in earlier, or working later, to try to work orders in the best hours.

If an overseas trader is working in the US secondary market for investment grade (IG) bonds it might be tempting to think that from Europe they can work the first half of the day in the US, or from Asia Pacific they should only work the second part of the day.

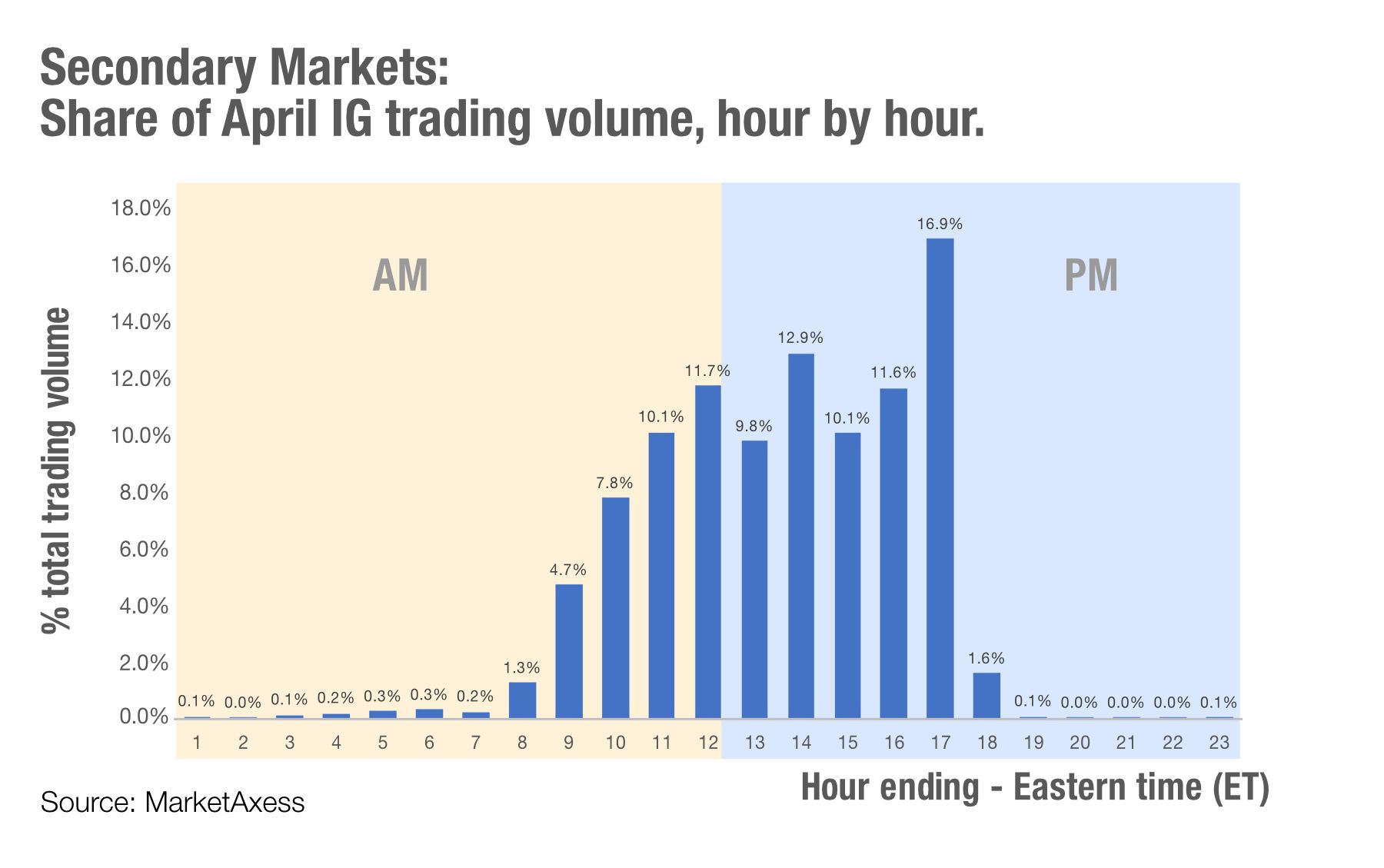

Data from April 2021 from MarketAxess shows that having a clear understanding of when to trade can be invaluable for a desk. Best execution can be dependent on multiple factors including price, speed, order completion, time, information leakage and market impact.

In the US over the past month, trading up to 12pm ET – which equates to 5pm GMT – would miss out a significant proportion of trading volume, notably that at the end of the day. Not only do volumes change but – depending upon the bonds in question – spreads tend to tighten during the day as more market data is available leading bond pricing to move towards a consensus, reducing uncertainty.

Although this chart gives a high level view of the difference throughout the day, it should be noted that a very granular analysis of the specific markets that a firm is trading in has to assessed if trading into a country from outside. The exact differences between high yield and investment grade trading volumes and spreads can be significant and will be affected by pricing guidance from primary markets as well as consensus.

What this really tells us is that a trading desk needs to build an information picture – looking before they leap – as they start to move into new markets or they may find that price and liquidity formation are severely compromised by the timing they have available to them.

©Markets Media Europe 2025