The Trading Intentions Survey 2022

New platforms and late bloomers are all seeing greater interest.

This year buy-side desks have a renewed vigour for investing in trading tools, with far...

Subscriber

Implications of Atlanta Fed negative GDPNow score for US credit

The Atlanta Federal Reserve’s GDPNow estimate for real GDP growth in the US hit 2.4% on 6 March 2025, up from -2.8 percent on 3 March,...

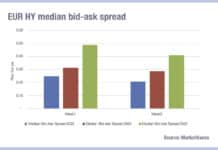

Bid-ask spreads see double-digit tightening in early 2025

Analysis of MarketAxess’s CP+ data, which analyses composite trading costs based on traded bonds, has found that bid-ask-spreads have tightened by double digit percentages...

Measuring digital bond issuance

The use of distributed ledger technology (DLT) to issue bonds can tackle several concerns in the debt markets. Firstly, it reduces the fragmented information...

US markets seeing risk implied in bid-ask spread

While US stock markets are in turmoil, US investment grade bond markets are also reflecting the greater uncertainty caused by an erratic approach to...

Emerging markets see liquidity costs decline

The cost of liquidity in emerging markets appears to be falling for fixed income traders. Looking at MarketAxess’s CP+ consolidated price feed, and cross-referencing...

Analysis: E-trading platforms see gains and losses in corporate bond market battle

Morgan Stanley analysis of the monthly reports from market operators Tradeweb and MarketAxess, has shown wins and losses in market share for both platforms.

Looking...

Invesco’s 2023 Fixed income outlook: ‘A promising year after a painful selloff’

Invesco has published its outlook for fixed income markets in 2023, noting that valuations now look more attractive, and yields are higher than they...

Portfolio trading breaks into new markets

Emerging markets are adopting PT to add efficiency to liquidity sourcing, writes Matt Walters of MarketAxess.

Portfolio trading has seen a lot of success and...

Tradeweb and MarketAxess see credit volumes increase over 25% in December

Market operators MarketAxess and Tradeweb have released their December trading levels, with both seeing a monthly increase of 25% in credit trading average daily...