US HY volumes hit yearly highs post-Liberation Day

US high yield (HY) trading volumes hit yearly highs last week as the country comes to terms with the implications of Trump’s ‘Liberation Day’...

Trade munis like a champion.

To kickoff Muni Madness, MarketAxess are unveiling their latest White Paper that details the methodology behind this revolutionary pricing tool that brings transparency to...

Debt deals decline

Debt markets have seen a year-on-year (YoY) decline in deal activity in 2025, according to data from Dealogic, reflecting the pensive mood amongst corporations...

Is rising credit risk displaying in bid-ask spreads?

US credit markets are seeing a divergence in bid-ask spreads and trade sizes between high yield and investment grade bonds, according to data from...

US markets seeing risk implied in bid-ask spread

While US stock markets are in turmoil, US investment grade bond markets are also reflecting the greater uncertainty caused by an erratic approach to...

Implications of Atlanta Fed negative GDPNow score for US credit

The Atlanta Federal Reserve’s GDPNow estimate for real GDP growth in the US hit 2.4% on 6 March 2025, up from -2.8 percent on 3 March,...

Picturing uncertainty in a traditionally stable market

Trading numbers in secondary corporate bond markets appear to reflect anecdotal reports of volatility bursts, as political false starts impact the reading of major...

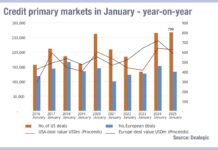

Retreat in credit market primary activity in January 2025, Munis a bright spot

In January 2025, Debt Capital Markets (DCM) for credit issuance retreated in the US and in Europe while primary activity for municipal bonds (Munis)...

Emerging markets see liquidity costs decline

The cost of liquidity in emerging markets appears to be falling for fixed income traders. Looking at MarketAxess’s CP+ consolidated price feed, and cross-referencing...

Measuring digital bond issuance

The use of distributed ledger technology (DLT) to issue bonds can tackle several concerns in the debt markets. Firstly, it reduces the fragmented information...