Is European credit electronification bouncing back?

There has been a noted proportional increase in electronification of US credit trading, as tracked by Coalition Greenwich. However, metrics around European trading found...

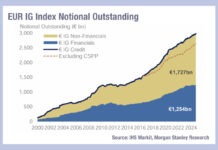

Ongoing effect of CSPP on European credit markets

Europe has seen considerable growth in credit issuance this year relative to 2023, with last week finding a 116% year-on-year increase in non-financial high...

Enhanced execution through automation

Andrew Cameron, Automation Solutions at MarketAxess, discusses the benefits of automation in trading.

Automation technologies have revolutionised so many aspects of our lives that it’s...

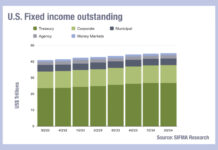

Money markets begin to tail off as rates fall

Reviewing the second quarter activity in primary markets and fund flows, we see the total notional outstanding in US fixed income totalled US$45.3 trillion,...

Who can make money, market making Euro credit?

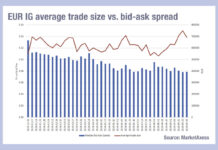

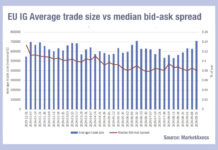

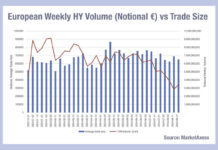

Looking at the average bid-ask spreads of European credit trades, and correlating them with the average trade sizes for the year to date based...

The Book: Expectations for common European debt issuance

A report by Mario Draghi, former European Central Bank president, looking at paths forward to improve the European Union’s competitiveness, has found a solid...

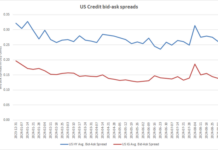

Falling costs of liquidity not halted by summer vol

The bid-ask spread for corporate bond markets has continued on a downward trajectory in September, after a bump in August, according to data from...

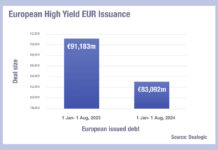

The Atlantic divide over high yield – is private credit biting?

Issuance of USD versus Euro high yield debt shows a significant split, based on Dealogic data, with US markets in 2024 issuing more than...

MarketAxess: Blockbusting Part 4 – Block Execution in US HG

In the latest of MarketAxess' Blockbusting series, our research team explores liqiudity profiles of block-sized RFQ trades between $1M- $10M on MarketAxess across a...

The effect of trade sizes on high yield liquidity costs

Trading in high yield markets across the Atlantic is diverging considerably, with average trade sizes and bid-ask spreads tracking quite different patterns, according to...