July 2023: Tradeweb sees total credit ADV jump 30% YoY in July driven by...

At Tradeweb, in July 2023, fully electronic US credit ADV was up 34.8% YoY to US$4.8 billion and European credit ADV was up 38.6%...

Coalition Greenwich: Dealers holding long-dated bonds again; net Treasury positions double

Dealers are holding positive levels of longer-dated corporate bonds in their inventories again, and treasury bills drove volume growth in H1 2023, according to...

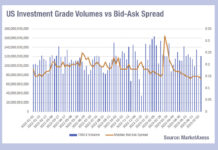

Implied cost of liquidity falling, with US high yield an exception

Volumes in the corporate bond markets have been picking back up, relative to bid-ask spreads, indicating an improving liquidity picture across the US and...

7 Chord and Bonds.com partner to deliver executable pricing data

Bonds.com and predictive pricing and analytics firm 7 Chord have partnered to combine bonds.com’s executable pre-trade pricing data with BondDroid AI, 7 Chord's real-time...

BondCliQ’s new portfolio trade reporting changes understanding of volumes and counterparties

Market data solutions provider, BondCliQ, will be launching a dynamic weekly report which aggregates and analyses data on US portfolio trading (PT) from TRACE,...

Flow Traders: Algos supported 20% of bond flows in 2022

A new white paper from exchange traded fund (ETF) market maker, Flow Traders, estimates that in the past two to three years, credit algos...

April showers on e-trading platform growth

Last month saw electronic trading platforms continue to grow, but with activity hit by the concerns around financials, leading multi-asset market operator, Tradeweb, to...

Review: Mixed bond trading revenues in choppy first quarter

Banks have seen mixed results from bond trading in the first quarter of 2023, across credit and rates, while electronic trading platforms have seen...

bondIT: Elevated global risk of credit re-ratings

bondIT, a provider of credit analytics and next-generation investment technology, has published its quarterly credit risk forecast, indicating an elevated credit risk across the...

Candriam promotes bond chief to CIO

Candriam, the global multi-asset manager has appointed Nicolas Forest, Candriam’s global head of fixed income since 2013, as its new chief investment officer (CIO),...