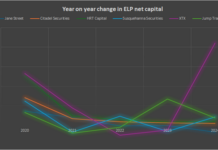

Risk profiling electronic market makers after Jane Street, Jump re-rated

Last year, Jane Street and Jump Trading had their rating outlooks upgraded by ratings agencies, as they overcame potential hurdles facing their businesses. Electronic...

Worsening credit outlook does not hurt credit trading

The corporate bond market has stood up to the test of tariffs – but will the corporate environment? As earnings season kicks in, companies...

The interplay between the cash and derivative credit markets

For investors, the derivatives market is a potentially a rich source for investment returns and risk management. It can also be a valuable source...

EMCA 2024 WINNER – Instinet Positive Change Visionary

EMCAs – Stacey Parsons, Winner of the Instinet Positive Change, Visionary award, 2024

Stacey Parsons, managing director of capital markets and head of fixed income...

The credit trading processes you really should have automated by now…

Automation has historically been highly challenging in corporate bond markets for several reasons, but traders say some parts of the workflow ‘ought’ to be...

Balls calls for UK to adopt a more risk-assertive culture

Ed Balls, former economic secretary to the UK Treasury & shadow chancellor, has called for the UK to adopt a risk-positive culture in order...

Trivedi joins Nuveen Credit Strategies Income Fund, expanding asset allocation

Nuveen Credit Strategies Income Fund has seen the firm’s head of structured credit, Himani Trivedi, appointed to the firm’s portfolio management team.

Trivedi is...

Exclusive: Rathbone Unit Trust Management outsources trading to Northern Trust

Rathbones, the investment and wealth manager with US$60 billion (US$74 billion) assets under management (AUM) has confirmed its Rathbone Unit Trust Management team is...

MSIM launches two new bond funds

Morgan Stanley Investment Management (MSIM) has announced the launch of two new funds, the MSINVF Short Maturity Euro Corporate Bond Fund and the MSINVF...

AXA IM: Credit downgrades increases concentration and liquidity risk in index investment

A decrease in the average credit quality of fixed income indices and intensifying competition for high quality assets present increasingly serious challenges for UK...