Study finds 21% of buy-side lost access to tradable instruments in crisis

A new ‘Derivatives Insight Report’ by analyst firm Acuiti has found that 21% of buy-side firms, including proprietary trading firms and asset managers, suffered...

Report: China’s pension stress represents opportunity for global buy side

Global asset managers should take note of the investment opportunities presented by China’s pension fund market as the space embraces much-needed reform and technological...

Muting Ren joins American Century Investments

Muting Ren has joined American Century Investments on its global Fixed Income Team. He will serve as senior portfolio manager and head of systematic...

Aegon Asset Management appoints global CIO for fixed income

Aegon Asset Management has appointed Russ Morrison as its new global chief investment officer responsible for managing its €170 (US $188) billion fixed income...

Rathbone Funds adopts Charles River IMS and State Street Alpha Data Platform

Rathbone Funds, the London-based subsidiary of Rathbones Group, has selected the Charles River Investment Management Solution (IMS) to support their equity, fixed income and...

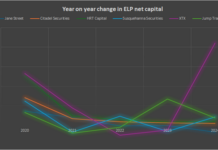

Risk profiling electronic market makers after Jane Street, Jump re-rated

Last year, Jane Street and Jump Trading had their rating outlooks upgraded by ratings agencies, as they overcame potential hurdles facing their businesses. Electronic...

Buy side finds trading on the turn no less challenging

When everyone was selling and no-one was buying liquidity vanished. However, as bond market outflows lessen, and in some cases reverse, many buy-side traders...

Bloomberg wins over AB and Capital Group with BVAL

AllianceBernstein (AB) and Capital Group have both selected Bloomberg's evaluated pricing service (BVAL) to benchmark and corroborate end-of-day values for US fixed income portfolio...

AXA IM: Credit downgrades increases concentration and liquidity risk in index investment

A decrease in the average credit quality of fixed income indices and intensifying competition for high quality assets present increasingly serious challenges for UK...

Clearlake Capital and Motive Partners to acquire BETA+ from LSEG

Private equity firms Clearlake Capital Group and Motive Partners have agreed to acquire the BETA+ assets from London Stock Exchange Group (LSEG), encompassing the...