Japanese bond vigilantes have a JGB one-way bet

Front-month ten-year Japanese Government Bonds (JGBs) futures are down 7% since early 2025 as volumes spike on down days, while the 10-year yield has...

Roupie joins Marex

Christophe Roupie has resurfaced at Marex, joining the firm as global head of electronic trading and platforms.

In October 2025, the firm expanded its fixed...

Yang joins ING

Alex Yang has joined ING as global head of electronic fixed income trading.

ING reported €5.9 billion in total income for Q3 2025, remaining almost...

LSEG expands post trade solutions business

LSEG has expanded its post-trade solutions business with a digital settlement service, offering instant settlement between payment networks on and off chain.

Digital Settlement House...

Kierton joins BlackRock

George Kierton has joined BlackRock as a vice president and emerging markets trader.

BlackRock holds a reported US$14 trillion in assets under management.

Earlier this week,...

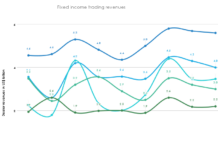

Mixed results at dealers as rates and FX power US Q4 FICC trading

JPMorgan had the largest fixed income, currencies and commodities (FICC) revenues amongst US banks at US$5.4 billion for the last quarter of 2025 with Goldman showing the strongest year on year growth on rates and FX trading. Citi and BofA FICC results were...

Hsu jumps from BlackRock to Balyasny

Vicky Hsu has joined Balyasny Asset Management as head of counterparty credit, leaving BlackRock after more than 17 years.

Balyasny holds US$31 billion in assets...

MUFG Securities America becomes US primary dealer

The New York Fed has authorised MUFG Securities America (MUSA) as a primary dealer, allowing it to take part in the reserve bank’s open...

‘Disbelief’ is becoming market response to US policy announcements

The failure to support policy and public announcements by the current US administration has hurt investors enough that they no longer react to public...

BNY bolsters digital cash offering

Certain deposits at BNY will now be tokenised as the bank pushes ahead with its digital asset initiative.

The service will initially be available for...