Implications of Atlanta Fed negative GDPNow score for US credit

The Atlanta Federal Reserve’s GDPNow estimate for real GDP growth in the US hit 2.4% on 6 March 2025, up from -2.8 percent on 3 March,...

Mexican bond markets: Keep your friends close

Sitting next to the US in the current trade war meant that Mexico avoided the highest bracket of US tariffs, thanks to its existing...

The Book: BofA DCM team give issuers confidence for financing in 2025

The DESK spoke with Bank of America’s Julien Roman, head of EMEA DCM FIG Origination, Paula Weisshuber, head of EMEA Corporate DCM, and Adrien...

Country focus: India’s bond markets in an election year

India has an upcoming election on 19 April, which the governing Bharatiya Janata Party (BJP), led by incumbent Prime Minister Narendra Modi, is widely...

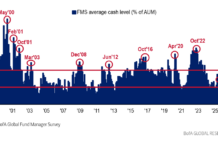

Investor Demand: BofA sees investor sentiment bounce back in May

The Bank of America Global Fund Manager Survey (FMS) has seen the scaling back of US-China tariffs as a net positive for activity. In...

Analysis: Market response to US Treasury’s increased borrowing needs

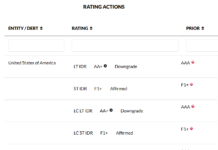

The US Treasury’s need to increase debt issuance, beyond market expectations, has had several effects. Firstly there was a ratings downgrade of the USA...

Risk of fiscal crisis in US from growing federal debt

A new report from the Congressional Budget Office (CBO) has found that if current laws governing taxes and spending generally remained unchanged, the federal...

Subscriber

Tom Porcelli named PGIM Fixed Income chief US economist

PGIM Fixed Income, a firm With US$793 billion in assets under management (AUM), has named Tom Porcelli chief US economist, effective 6 July 2023....

Implication of US bank downgrades on credit markets

Markets are truly feeling the economic pressures at present, with Moody’s downgrade to US financials on Monday following Fitch’s controversial downgrade of the US,...

The US: Too big to Fitch?

Ratings agency Fitch has downgraded the United States’ long-term credit ratings to AA+ from AAA and removed the rating ‘Watch Negative’ stating “ reflects...