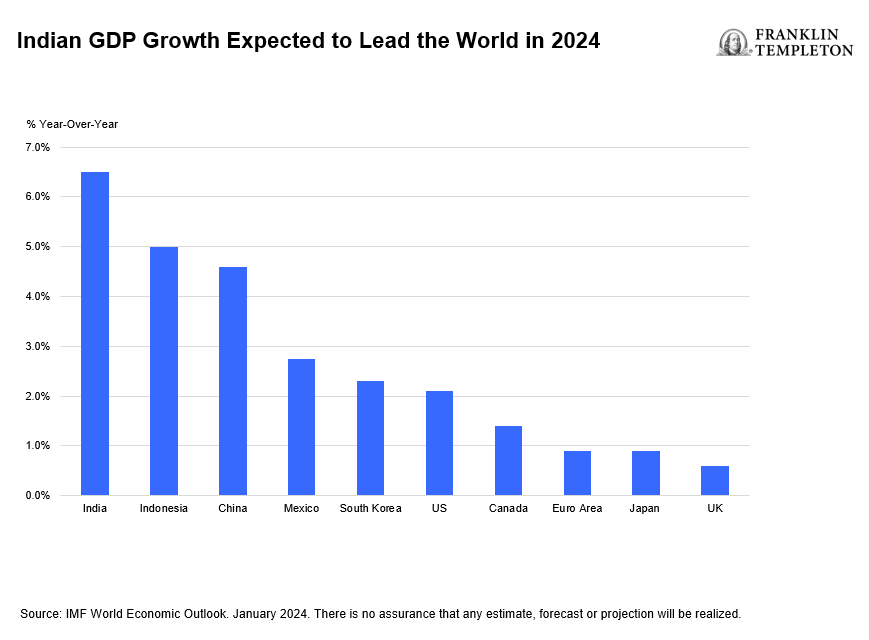

India has an upcoming election on 19 April, which the governing Bharatiya Janata Party (BJP), led by incumbent Prime Minister Narendra Modi, is widely tipped to win, thanks in part to the success of its economy.  “A combination of factors is driving investor confidence in a BJP win,” writes Franklin Templeton’s Emerging Markets Equity team. “The party maintains a solid economic record, with this year’s gross domestic product (GDP) growth the highest among large global economies. The party is also well organised. Party representatives will be present at the majority of the one million polling stations in India, where 969 million voters cast their votes. The party also has a record of meritocracy in selecting candidates, which creates an inclusive environment and reduces the risk of internal splintering.” India’s bond markets are also set for a win, with JP Morgan Asset Management announcing in September 2023 that Indian Government Bonds (IGBs) would be included in its Government Bond Index-Emerging Markets (GBI-EM) from June 2024, and in March 2024 Bloomberg announcing the inclusion of India Fully Accessible Route (FAR) bonds in the Bloomberg Emerging Market (EM) Local Currency Government Index and related indices, to be phased in over a ten-month period, starting 31 January 2025. However, inclusion of Indian debt on the FTSE Emerging Markets Government Bond Index (EMGBI) has been deferred. The country was added to the watch list fo the index in March 2021, following and despite FTSE Russell finding improvement to market operations, with progress in the accessibility of the government bond market since its previous review, the firm found the country’s increased regulatory reporting, inflexible settlement cycle length, tax clearance process and lack of documentary requirements to fulfil the Foreign Portfolio Investor registration were all still an issue, “FTSE Russell intends to continue its valuable dialogue with the Reserve Bank of India and welcomes feedback from an expanding cohort of international investors entering the Indian government bond market on the practicalities of their investment experience,” the company concluded. Positive sentiment Morgan Stanley analysts, Min Dai and Gek Teng Khoo, noted that on a recent trip to London, investors often told them, “I love the story in India but I hate the asset price.” A recent report by the International Capital Markets Association (ICMA), authored by Alex Tsang, Mushtaq Kapasi and Andy Hill, noted that prior to 2011 banks and a small number of corporate issuers from India tapped the international bond markets but, in that year, SOEs and quasi-government entities began using in international bond markets to raise funds.

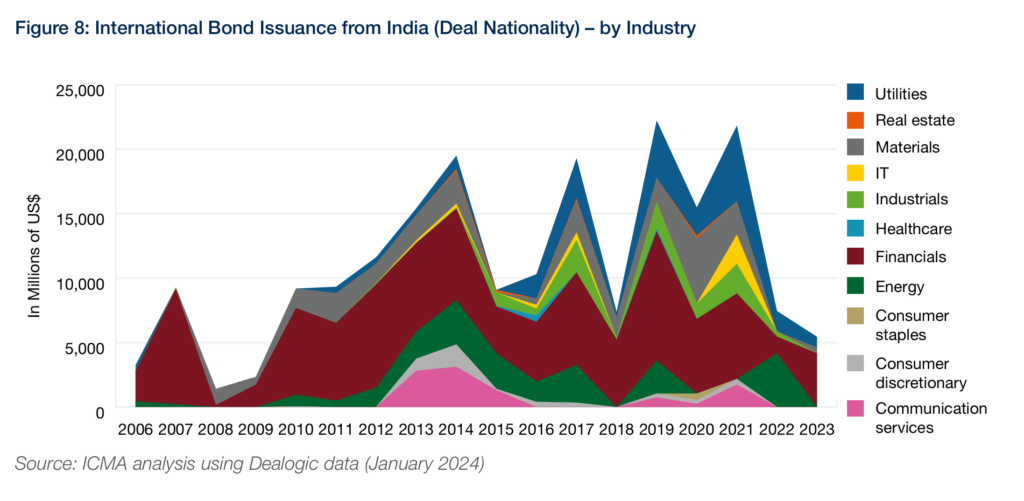

“A combination of factors is driving investor confidence in a BJP win,” writes Franklin Templeton’s Emerging Markets Equity team. “The party maintains a solid economic record, with this year’s gross domestic product (GDP) growth the highest among large global economies. The party is also well organised. Party representatives will be present at the majority of the one million polling stations in India, where 969 million voters cast their votes. The party also has a record of meritocracy in selecting candidates, which creates an inclusive environment and reduces the risk of internal splintering.” India’s bond markets are also set for a win, with JP Morgan Asset Management announcing in September 2023 that Indian Government Bonds (IGBs) would be included in its Government Bond Index-Emerging Markets (GBI-EM) from June 2024, and in March 2024 Bloomberg announcing the inclusion of India Fully Accessible Route (FAR) bonds in the Bloomberg Emerging Market (EM) Local Currency Government Index and related indices, to be phased in over a ten-month period, starting 31 January 2025. However, inclusion of Indian debt on the FTSE Emerging Markets Government Bond Index (EMGBI) has been deferred. The country was added to the watch list fo the index in March 2021, following and despite FTSE Russell finding improvement to market operations, with progress in the accessibility of the government bond market since its previous review, the firm found the country’s increased regulatory reporting, inflexible settlement cycle length, tax clearance process and lack of documentary requirements to fulfil the Foreign Portfolio Investor registration were all still an issue, “FTSE Russell intends to continue its valuable dialogue with the Reserve Bank of India and welcomes feedback from an expanding cohort of international investors entering the Indian government bond market on the practicalities of their investment experience,” the company concluded. Positive sentiment Morgan Stanley analysts, Min Dai and Gek Teng Khoo, noted that on a recent trip to London, investors often told them, “I love the story in India but I hate the asset price.” A recent report by the International Capital Markets Association (ICMA), authored by Alex Tsang, Mushtaq Kapasi and Andy Hill, noted that prior to 2011 banks and a small number of corporate issuers from India tapped the international bond markets but, in that year, SOEs and quasi-government entities began using in international bond markets to raise funds.  “Issuance volume of international bonds from Indian issuers reached almost US$20 billion in 2017, then the volume dropped significantly in 2018 to about US$7 billion driven largely by domestic market credit events,” wrote Tsang, Kapasi and Hill. “However, issuance activities rebounded significantly in the following year with issuance volume reaching a recent high of US$22 billion since 2006 and remained above US$15 billion for two more years. Issuance volume subsequently declined to a 14-year low at about US$5 billion in 2023.” As the cost of hedging dollar issuance into rupees was higher than domestic borrowing, the value of using internal markets was limited. “Financial institutions were the dominant Indian issuers of international bonds and contributed 76% of total issuance volume in 2023,” noted the ICMA team. “This was in contrast with 2022, in which energy companies accounted for more than half of total issuance volume, followed by financial companies which contributed about 18% of total issuance volume.”

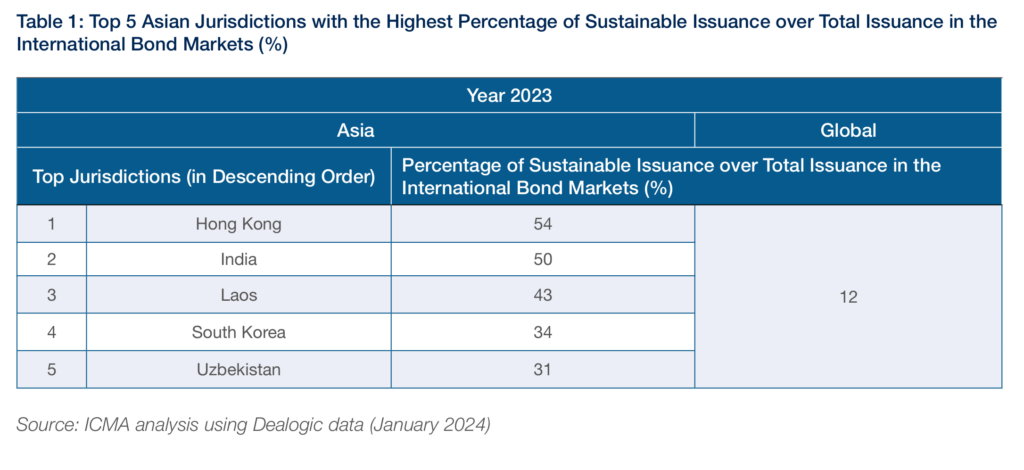

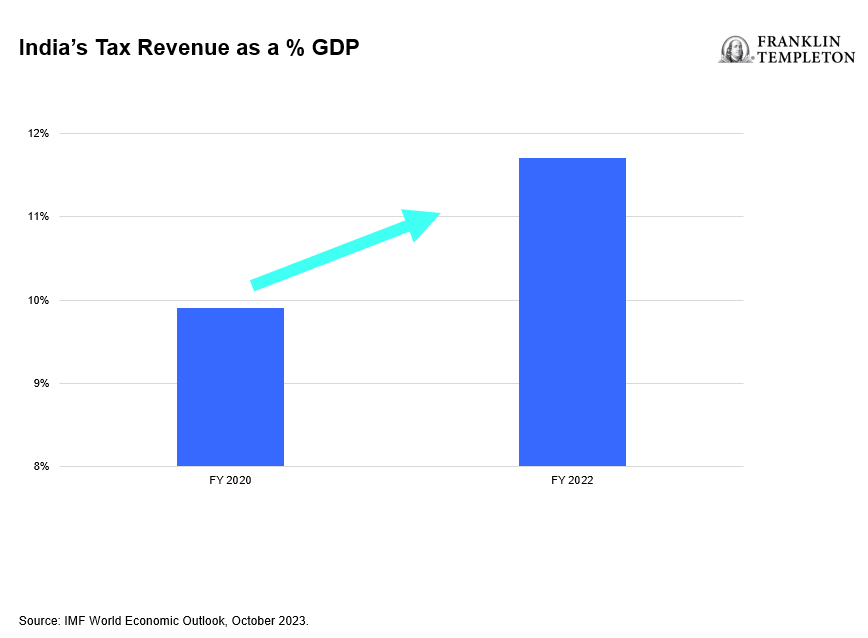

“Issuance volume of international bonds from Indian issuers reached almost US$20 billion in 2017, then the volume dropped significantly in 2018 to about US$7 billion driven largely by domestic market credit events,” wrote Tsang, Kapasi and Hill. “However, issuance activities rebounded significantly in the following year with issuance volume reaching a recent high of US$22 billion since 2006 and remained above US$15 billion for two more years. Issuance volume subsequently declined to a 14-year low at about US$5 billion in 2023.” As the cost of hedging dollar issuance into rupees was higher than domestic borrowing, the value of using internal markets was limited. “Financial institutions were the dominant Indian issuers of international bonds and contributed 76% of total issuance volume in 2023,” noted the ICMA team. “This was in contrast with 2022, in which energy companies accounted for more than half of total issuance volume, followed by financial companies which contributed about 18% of total issuance volume.”  With 50% of issuance in India classified as sustainable, the second highest in the region, ICMA found the determining factors for issuing domestically or internationally were funding costs, currency-matching in terms of the use of proceeds and profile-building purposes. “With rising tax revenues, the government has been able to support green investments and amplify its focus on investment in information technology hardware,” write the Franklin Templeton team. “Looking ahead, a reduced dependence on fossil fuel for power generation and a focus on value-added manufacturing for export could result in a currency account surplus, putting appreciating pressure on the INR/USD exchange rate. While import costs would be reduced in this scenario, if India successfully executes its supply side policies, in particular education reform, we believe the country should be able to compete internationally and not rely on a weaker exchange rate.” Overcoming disappointment Despite the setback with FTSE Russell, the inclusion of Indian debt in other indices is expected to drive up investor appetite, with Morgan Stanley’s analysis showing that in government securities, investors are embracing the upcoming index inclusion. “This is seen in the US$9 billion of inflows to G-Secs since last September,” write Min Dai and Gek Teng Khoo, “Most investors would like to own G-Secs as a core position upon inclusion and have 20-30% of their positions in surpranational issuances,” ICMA analysis suggests that if the US sees lower US yields, more Asian corporates could return to the international market from China, India and Korea. “Furthermore, it is hoped that international investors who were burned in recent years by the heightened volatility will slowly return to the market, particularly as increased supply helps to take some of the tightness out of the secondary market, so offering better value,” write Tsang, Kapasi and Hill. Franklin Templeton observes that no changes in policy are expected if the BJP wins the upcoming Indian general election, and if Modi achieves a two-thirds majority, he will have a mandate for constitutional change which it assess should be broadly positive for investors. Executing his economic priorities will be the greatest risk, for example as a result of an appreciating exchange rate

With 50% of issuance in India classified as sustainable, the second highest in the region, ICMA found the determining factors for issuing domestically or internationally were funding costs, currency-matching in terms of the use of proceeds and profile-building purposes. “With rising tax revenues, the government has been able to support green investments and amplify its focus on investment in information technology hardware,” write the Franklin Templeton team. “Looking ahead, a reduced dependence on fossil fuel for power generation and a focus on value-added manufacturing for export could result in a currency account surplus, putting appreciating pressure on the INR/USD exchange rate. While import costs would be reduced in this scenario, if India successfully executes its supply side policies, in particular education reform, we believe the country should be able to compete internationally and not rely on a weaker exchange rate.” Overcoming disappointment Despite the setback with FTSE Russell, the inclusion of Indian debt in other indices is expected to drive up investor appetite, with Morgan Stanley’s analysis showing that in government securities, investors are embracing the upcoming index inclusion. “This is seen in the US$9 billion of inflows to G-Secs since last September,” write Min Dai and Gek Teng Khoo, “Most investors would like to own G-Secs as a core position upon inclusion and have 20-30% of their positions in surpranational issuances,” ICMA analysis suggests that if the US sees lower US yields, more Asian corporates could return to the international market from China, India and Korea. “Furthermore, it is hoped that international investors who were burned in recent years by the heightened volatility will slowly return to the market, particularly as increased supply helps to take some of the tightness out of the secondary market, so offering better value,” write Tsang, Kapasi and Hill. Franklin Templeton observes that no changes in policy are expected if the BJP wins the upcoming Indian general election, and if Modi achieves a two-thirds majority, he will have a mandate for constitutional change which it assess should be broadly positive for investors. Executing his economic priorities will be the greatest risk, for example as a result of an appreciating exchange rate  “In our view, any future exchange rate appreciation is likely to be gradual, so policymakers can liberalise the capital account in stages to manage the upside,” the firm writes.

“In our view, any future exchange rate appreciation is likely to be gradual, so policymakers can liberalise the capital account in stages to manage the upside,” the firm writes.

©Markets Media Europe 2024