Tag: JP Morgan

Optimising execution in Qatari and Kuwaiti bond sell-off

Buy-side traders need to carefully manage order execution when a bond market moves into or out of an index, as the large directional moves...

The pretenders, and kingmakers, to the bond throne

Dealers are backing several new trading platforms who are fighting major incumbents for market share.

In the bond market, the trading platform landscape has been...

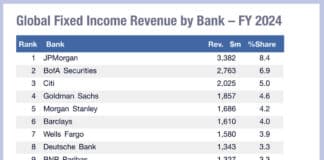

JP Morgan leads Q1 trading results, Dimon calls for deregulation

JP Morgan raced ahead of competitors in fixed income trading revenues over the first three months of 2025, reporting over US$1 billion more than...

Electric dreams in global rates markets

Electronic trading between dealers and buy-side institutions is taking different paths in government bond markets, globally. Lucy Carter investigates.

“We have seen growth in the electronification of...

The Book: JP Morgan rules the roost in Q1 DCM market...

JP Morgan has retained its top spot in global debt capital markets rankings by volume for Q1 2025, according to Dealogic.

With US$178.5 billion, 806...

J.P. Morgan: Survey reveals specific growth opportunities for electronic trading

Expectations of volatility jump as traders across the market seek liquidity and cost management through single dealer platforms.

J.P Morgan’s annual E-trading Edit, a comprehensive...

Competition for debt issuance fierce as activity remains

Primary debt markets are likely to be a major revenue earner for dealers facing tighter margins in secondary bond markets. Issuance has started strongly...

MAS fines JP Morgan over fee misconduct

The Monetary Authority of Singapore (MAS) has fined JP Morgan S2.4 million (US$1.79 million) over relationship manager misconduct, which resulted in clients being overcharged.

For...

Morgan Stanley an outlier as banks see FI trading revenues drop

In the third quarter of 2024, of five major banks – Citi, JP Morgan, Goldman Sachs, Bank of America and Morgan Stanley – only...

J.P. Morgan: Finding the best path in e-trading fixed income

Electronic trading may resolve key structural challenges in the market for buy-side traders, including instrument selection, with guidance from key dealers.

Chinedum Nzelu, head of...