Tag: International Capital Markets Association (ICMA)

The Book: ICMA releases DLT bond guidance

The International Capital Markets Association (ICMA) has released the latest reference guidance on distributed ledger technology (DLT)-based debt securities.

The paper has been developed in...

Rules and Ratings: EU associations call for credit rating-led bond transparency

AFME, the German Investment Funds Association (BVI), Bundesverband der Wertpapierfirmen (bwf), EFAMA and ICMA have encouraged the EU to calibrate corporate bond transparency regimes...

“A vital first step”; FCA transparency regime sees industry approval

The International Capital Markets Association (ICMA) and Association for Financial Markets in Europe (AFME) have issued their full support for the FCA’s new transparency...

ICMA FinTech & Digitalisation Forum

Join the most innovative thinkers in the industry at this exciting full day conference, the 2024 ICMA FinTech and Digitalisation Forum, which will be...

Market reforms spark “cautious optimism” for KTB engagement

Recent market reforms could turn around low engagement with Korean Treasure Bond (KTB) trading, according to research from Bloomberg and the International Capital Markets...

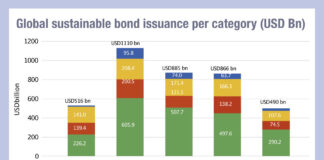

Sustainable bond issuance now 12% of total market

A report co-authored by Nicholas Pfaff, Valérie Guillaumin, Simone Utermarck, Ozgur Altun and Stanislav Egorov of the International Capital Markets Association (ICMA), has found...

FILS USA: The most valuable fixed income asset is ‘People’

Much of the talk at last week's Fixed Income Leaders Summit in Boston centred around the mechanics of buying and selling bonds: data and...

Country focus: India’s bond markets in an election year

India has an upcoming election on 19 April, which the governing Bharatiya Janata Party (BJP), led by incumbent Prime Minister Narendra Modi, is widely...

Port in a storm: Asian international bond markets resilient amid volatility

Volatile interest rates, a fractious geopolitical landscape, and rumbles in the Chinese property sector. Despite these headwinds, the international bond markets in Asia were...

Subscriber

Germany’s rates market comfort

Germany’s government bond market is in rude health, according to the latest analysis of sovereign debt by Andy Hill, director at the International Capital...