US markets seeing risk implied in bid-ask spread

While US stock markets are in turmoil, US investment grade bond markets are also reflecting the greater uncertainty caused by an erratic approach to...

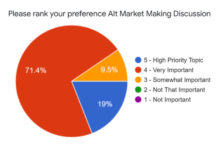

Credit Market Structure Alliance: The real market agenda

The CMSA, invitation-only event, is setting an agenda based on market professionals’ concerns, and has captured a groundswell of interest.

The DESK: What has been...

Subscriber

Fink: BlackRock’s private credit strategy ties Prequin and Aladdin

In BlackRock’s second quarter (Q2) earnings call, CEO and chairman, Larry Fink, has set out the firm’s vision of expansion into private credit markets.

He...

Citi asserts control over any data tied to bilateral client trades

The European credit trading team at Citi has, according to several large asset managers, told buy-side clients the bank owns any data relating to...

Dealers warned about counterparty credit risk by ECB head

Using a blog post, Andrea Enria, chair of the Supervisory Board of the European Central Bank (ECB) has highlighted risks facing the sell-side around...

Lars Salmon: On internal strength

Fidelity International has homegrown internal expertise and tech, to support a fixed income trading team that can weather all markets.

Lars Salmon is head of...

Flextrade and BlackRock platforms to integrate, extending OEMS consolidation trend

Execution management system (EMS) provider Flextrade and Aladdin, the order management system (OMS) developed by asset manager BlackRock, are to deepen their partnership, with...

Citadel Securities’ new hires are reinforcing US credit market expansion

Citadel Securities has seen a spate of hirings on its credit trading teams in January 2024, supporting its expansion into the corporate bond space...

Ediphy Markets launches Ediphy Credit

Ediphy Markets has launched Ediphy Credit, a service to help institutional asset managers access better liquidity in corporate bonds. Ediphy Credit combines data analytics...

Sean George joins Millennium Capital Partners

Sean George has been named portfolio manager at Grace Court Capital, a credit fund division of Millennium Capital Partners, which has US$52 billion in...