BNY and Goldman Sachs launch tokenised money market fund shares

The Bank of New York Mellon Corporation and Goldman Sachs have announced a collaborative initiative in which BNY is expected to use blockchain technology...

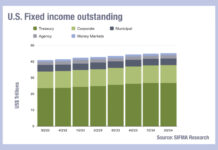

Money markets begin to tail off as rates fall

Reviewing the second quarter activity in primary markets and fund flows, we see the total notional outstanding in US fixed income totalled US$45.3 trillion,...

Candriam promotes bond chief to CIO

Candriam, the global multi-asset manager has appointed Nicolas Forest, Candriam’s global head of fixed income since 2013, as its new chief investment officer (CIO),...

TransFICC launches eTrading service for interest rate swaps

TransFICC, the specialist provider of low-latency connectivity and workflow services for fixed income and derivatives markets, has launched a new eTrading service, which combines...

Tradeweb monthly ADV up 20% year-on-year

Market operator Tradeweb has reported a total trading volume of US$19.8 trillion for August 2021 across its electronic marketplaces for rates, credit, equities and...

Tradeweb reports US$18.5 trillion traded in September

Market operator Tradeweb has reported a total trading volume for September of US$18.5 trillion, with an average daily volume (ADV) for the month of...

Tradeweb sees volume drop in June

Bond market operator, Tradeweb, has reported its average daily volume (ADV) in June was US$780.9 billion (bn), a decrease of 8.9% year-on-year (YoY), largely...

Money market and repo platforms see big volumes; MTS widens footprint

The European Central Bank estimated turnover in wholesale unsecured money markets in Europe alone was €127 billion (US$137 billion) per day in Q1 2020....

The Fed opens registration for commercial paper facility

The Federal Reserve Bank of New York has opened registration for firms wishing to sell to its Commercial Paper Funding Facility (CPFF).

The commercial paper...

Change is jangling money market funds

Lynn Strongin Dodds looks at the impact of liquidity and settlement reforms.

Regulatory reform, which has been a very long time coming in the US$4.46...