Coalition Greenwich predicts electronic revolution for the MBS market

A new study by Coalition Greenwich analyst Audrey Costabile posits that Mortgage Backed Securities trading will electronify over the next five years. Along with...

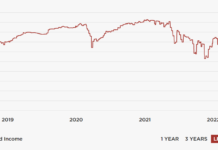

Denmark FSA investigating bond funds’ double-figure losses

Sources report the Danish Financial Services Authority (DFSA) has launched an investigation into fund losses from mortgage bond holdings, as rising interest rates have...

BNY Mellon adds agency MBS to new DTCC cleared repo sponsored member programme

US post-trade market infrastructure giant, the Depository Trust & Clearing Corporation (DTCC), has launched its Sponsored General Collateral (GC) Service, a new offering from...

Tradeweb saw ADV hit US$1 trillion in January 2021

Market operator Tradeweb has reported its total trading volume for January was US$20 trillion across its electronic marketplaces for rates, credit, equities and money...

Tradeweb reports December 2020 volume up nearly 30% year-on-year

Bond market operator Tradeweb has reported its total trading volume for December was US$18.2 trillion across its marketplaces for rates, credit, equities and money...

Tradeweb expands mortgage trading platform to originators

Fixed income market operator, Tradeweb, has expanded its platform for trading specified pools of mortgages, now enabling mortgage originators to trade alongside other secondary...

Tradeweb sees volume drop in June

Bond market operator, Tradeweb, has reported its average daily volume (ADV) in June was US$780.9 billion (bn), a decrease of 8.9% year-on-year (YoY), largely...

Fed’s Treasury Market Practices Group sheds light on March liquidity crisis

Minutes of the 31 March meeting of the Federal Reserve’s Treasury Market Practices Group (TMPG), including an update on a 19 March call between...