EM traders ride out the chaos

It would be understandable if trading in emerging markets (EM) debt were becoming more expensive as risk increased in many markets it makes up,...

Signalling risk in credit, if one counterparty is 50% volume

How do you avoid information leakage? Does this change if half the market is trading with a single counterparty? Knowing that electronic market maker,...

Electronification of US credit delivers resilience

The electronification of the US corporate bond markets has demonstrated that its improved efficiency has strengthened depth of liquidity provision, rather than made it...

Treasury futures fight intensifies between FMX and CME

The US Fixed Income Leaders Summit 2025 showcased the fierce rivalry in the US treasury futures space, between incumbent giant exchange CME and upstart...

Portfolio trading proves transformational, but controversial

The US market has been transformed by portfolio trading (PT) this year, with estimates that PT makes up somewhere between 25-40% of dealer-to-client (D2C)...

TradFi meets DeFi: Integrating FIX and distributed ledgers

Led by global co-chair Digital Assets & Technology Committee, Vince Turcotte, 35 participants from the APAC digital assets ecosystem gathered at the 23rd Asia...

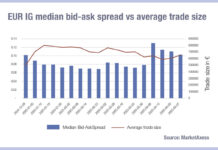

When volatility improves credit liquidity

Credit market liquidity has been positive in the first half of 2025, despite the high levels of volatility.

There are several dynamics which might be...

The pretenders, and kingmakers, to the bond throne

Dealers are backing several new trading platforms who are fighting major incumbents for market share.

In the bond market, the trading platform landscape has been...

Rules & Ratings: S&P warns on forecast uncertainty

S&P Global Ratings has said it believes a high degree of unpredictability exists around policy implementation by the US administration and possible responses regarding...

European bid-ask credit spreads not assuaged by tariff roll back

Liquidity costs in European corporate bond trading remain elevated, after the tariff shock in early April saw bid-ask spreads widen significantly across markets, according...