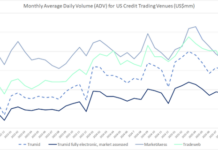

Tradeweb and MarketAxess beat TRACE growth in November

US electronic credit activity firmed in November. On FINRA’s TRACE tape, combined US investment-grade and high-yield average daily volume (ADV) rose to US$57.8 billion,...

IOSCO sets pre-hedging guard rails, amid calls for ban

The International Organisation of Securities Commissions (IOSCO), has published its final report on pre-hedging, amid call for the practice to be banned, and allegations...

Secular vs cyclical: How e-trading, issuance and credit spreads align with liquidity

Primary markets are a crucial source of liquidity in secondary markets, as new issues trigger a round of buying and selling activity for newly...

“A fixed income price is not a fact. A fixed income price is an...

David LaRusso is the head of fixed income trading at Dimensional Fund Advisors, and has just celebrated his 25th anniversary at the firm. The...

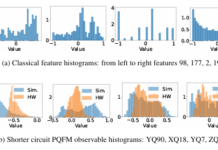

Quantum computing ‘breakthrough’ has “more red flags than a People’s Liberation Army parade”

The claim by HSBC that noise in an IBM quantum computer helped deliver a 34% improvement in algorithmic trading performance has been disputed by...

Argentina’s battle for control

Argentina’s bond markets have been notoriously challenging for investors. Twenty years after the country underwent a major debt restructuring, and just five years after...

What Mexico’s vol risk means for trading LatAm bonds

In Latin American (LatAm) markets, economic volatility may transfer into market volatility – most notably in Mexico.

In order to manage risk and seize opportunities...

Trade size growth undercuts European bond market ‘equitification’

Since 2023 European corporate bond markets have seen trades size grow, as trading platforms report increasing volumes

“If we break down electronic trading growth in European...

Traders welcome India’s bond e-trading evolution as regulator shows teeth

The Indian bond market provides a conundrum for investment traders, who fight to gain access to liquidity and pricing information on behalf of their...

Crunch on liquidity costs

As bid-ask spreads begin to widen on both sides of the Atlantic, buy-side credit traders need to reassess how to best manage the crunch...