How e-trading won bond investors an opportunity in the Venezuelan crisis

The dramatic escalation of Venezuela’s political crisis — culminating in the US military operation that removed Nicolás Maduro from power — has triggered a...

‘Disbelief’ is becoming market response to US policy announcements

The failure to support policy and public announcements by the current US administration has hurt investors enough that they no longer react to public...

Visualising the cost of credit trading cut in half since 2023

Credit markets have seen bid-ask spreads, a proxy for trading costs for the buy-side, tighten further in the first two weeks of 2026, relative...

Bid-ask spread volatility highest in US bond markets

When comparing liquidity across markets in 2025, buy-side bond traders may consider European investment grade markets to have an optimal set of characteristics. However,...

Dealogic: DCM deals in 2025 up 18% on five-year average

The preliminary view of 2025 capital markets deals, published by Dealogic, has found that global DCM volume delivered a total of US$9.5 trillion, 19%...

Opportunities in e-trading credit derivatives

Credit futures and swaps complement each other by providing investors with different but interconnected tools to manage credit risk, hedge exposures, and to gain...

IG issuance across US and Europe up 20% on five-year average

US investment grade debt issuance has hit $1.7 trillion year to date (YTD) in 2025, a 12% increase year on year (YoY). That brings...

US credit activity dropped off a cliff in late November

Analysis of US corporate bond market activity has found that trading volumes and counts plummeted going into the final month of the year. A...

How a credit sell-off might unfold…

Someone, somewhere, is cooking the books

In 2007, I explained the risks of cumulative capital market investments to a friend as a series of interconnected...

Credit trades’ double-figure yearly growth proves liquidity dividend

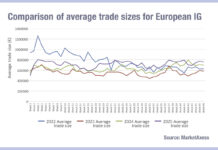

The gradual growth in trade sizes for European corporate bond trades is made clear in the latest MarketAxess TraX data comparison for data from...