September: US rates ADNV up 35% YoY amid wider uncertainty

In September, overall trading in US rates rose 1% year-over-year, standing at 59% of volumes, while the average daily notional volume stood at US$988...

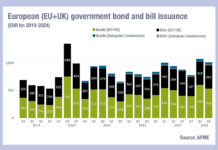

UK government debt issuance soars

The latest report from the Association for Financial Markets in Europe (AFME), looking at European government bond markets, found that €1 trillion of bonds...

The Book: Digital Asset and Euroclear tokenise gilts and Eurobonds

Digital Asset, a blockchain system provider, has completed a collaborative initiative to tokenise gilts and Eurobonds.

Euroclear, The World Gold Council, and global law firm...

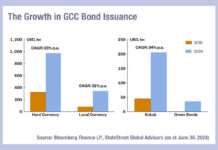

Key trends in emerging markets debt issuance in 2024

Emerging market debt is seeing the effects of government reforms in both democracies and autocracies this year, with stability being the watch word for...

Analysis: Electronic trading across US and European bond markets

Electronic trading of US credit erupted in May 2024, according to analysis of the US credit market by Coalition Greenwich. It found that investment...

Subscriber

Emerging market bonds issuance and returns grow

This week we examine the very directional movements of emerging markets (EM) assets under management (AUM), due to investment flows and growing issuance. With...

Country focus: India’s bond markets in an election year

India has an upcoming election on 19 April, which the governing Bharatiya Janata Party (BJP), led by incumbent Prime Minister Narendra Modi, is widely...

Portugal to join FTSE World Government Bond Index; India deferred

Portugal has been added to the FTSE World Government Bond Index (WGBI), effective November 2024. FTSE Russell stated that the country now meets all...

Coalition Greenwich: US Treasury e-trading volumes hit record in February

US Treasury volumes saw an average daily notional value (ADNV) of US$918 billion in February 2024, Coalition Greenwich’s March Data Spotlight has reported, up...

SGX anticipates Japanese growth with STIR futures

Singapore Exchange (SGX Group) plans to introduce short-term interest rate futures related to the Tokyo Overnight Average Rate (TONA) and the Singapore Overnight Rate...