What Mexico’s vol risk means for trading LatAm bonds

In Latin American (LatAm) markets, economic volatility may transfer into market volatility – most notably in Mexico.

In order to manage risk and seize opportunities...

Investor Demand: IG private credit creates ‘attractive entry points’ for investors

Research by Aviva Investors has broken down the illiquidity premia paid via private debt markets, noting that it is improving for investors, even as...

Get your trade dressed to kill (or execute)

Getting a trade to look attractive to a counterparty gets harder the more illiquid, large, and specific it is. As the purpose of a...

Trade size growth undercuts European bond market ‘equitification’

Since 2023 European corporate bond markets have seen trades size grow, as trading platforms report increasing volumes

“If we break down electronic trading growth in European...

Year-to-date issuance higher in corporate bonds as leveraged loans drop

Issuance of corporate debt in the US and European markets is looking relatively strong year to date, however loans have tailed off significantly, according...

European credit volumes plummet as US stays buoyant

European corporate bond markets have seen trading volumes and trade count collapse going into summer, as the holiday period provides some respite for tired...

Insights & Analysis: UBS tracks rising quality in US high yield

In an analysis of US credit fundamentals for high yield (HY) debt, investment banking giant, UBS, via its HOLT valuation service acquired from Credit...

Rosy picture for credit dealers as they lower IR risk

US dealer exposure to interest rate risk in their investment grade (IG) bond inventories hit its lowest level for twelve months in week of...

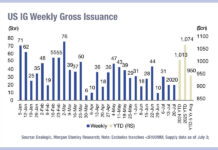

Second quarter issuance recovers after soft April and May

Morgan Stanley has reported that June issuance increased 13% year-on-year (YoY) following a 34% drop in April and 3% decline in May.

“Strong June issuance...

Signalling risk in credit, if one counterparty is 50% volume

How do you avoid information leakage? Does this change if half the market is trading with a single counterparty? Knowing that electronic market maker,...