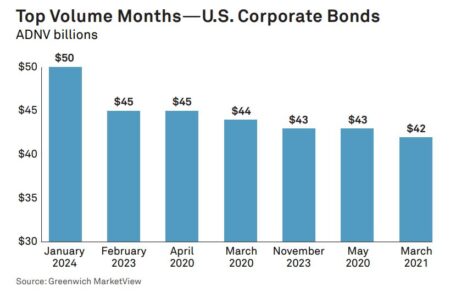

January 2024 saw the largest single volume day and largest average daily notional volume (ADNV) month ever for US corporate bonds.

$75 billion of investment grade and high yield bonds were traded on 31 January, capping off a month that saw ADNV rise to US$50 billion — 16% more than in January 2023.

According to Coalition Greenwich, 43% of investment grade bonds were traded electronically in January 2024, a 5% YoY increase while 30% of high yield bonds were traded electronically, a 1% YoY increase.

According to Coalition Greenwich, 43% of investment grade bonds were traded electronically in January 2024, a 5% YoY increase while 30% of high yield bonds were traded electronically, a 1% YoY increase.

While the 43% of investment grade bonds and 30% of high yield bonds traded electronically was not a record in percentage terms, the absolute ADNV traded electronically of US$21.4 billion was, Coalition Greenwich noted.

The combined IG and HY ADNV year to date (YTD) 2024, as reported by TRACE, was US$50 billion, up 31% from 2023 full year (FY).

The US$233 billion in US corporate bonds brought to market in January, 34% more than January 2023, is, in large part, responsible for the buoyant figures.

While new issuance can sometimes reduce secondary market trading activity if it provides asset managers with all the bonds they need, portfolio managers put in the work to reposition for the new year and the expected new interest-rate environment, Coalition Greenwich said.

Similarly, portfolio trading also drove the total market volumes higher. Portfolio trading accounted for 14% of notional volume traded at month end (US$11.1 billion), according to data from BondCliQ.

Report author and head of market structure at Coalition Greenwich, Kevin McPartland, said, “US Treasury bond trading activity in the past year has proven remarkably robust, with electronic trading tools and portfolio trading providing the mechanisms needed to efficiently shuffle the risk.”

Credit ETF volume did not keep up with the booming bond market in January, with the ETF-to-cash ratio dropping to just over 17%. The high-yield ratio saw the most notable drop to 35% from 44% in December and a 2023 high of 61% in July.

“However, the January 2024 ratio closely matched January 2023, suggesting traders start off the year focused on the bonds they need (and don’t) rather than gaining short-term exposure via ETFs,” he wrote.

Record e-trading volume was a positive for the major trading venues. Coalition Greenwich notes that ADNV for MarketAxess was only US$150 million short of its all-time record month (February 2023), coming in at nearly US$8.9 billion, including more than US$3 billion traded via Open Trading.

Similarly, Coalition Greenwich reports that Tradeweb landed record volumes in three of the past four months including January, with January’s ADNV hitting nearly US$7.4 billion as their volumes grow beyond their historic strengths of portfolio trading and dealer sweeps.

©Markets Media Europe 2024

©Markets Media Europe 2025