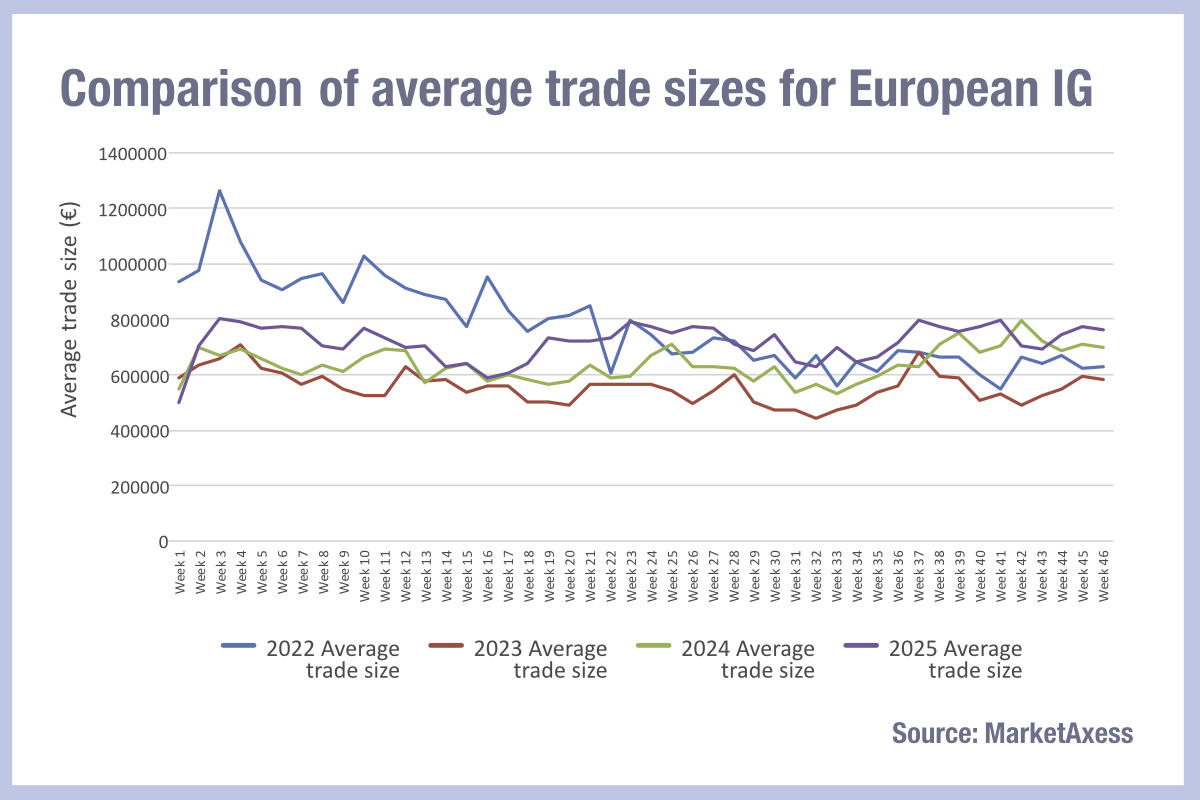

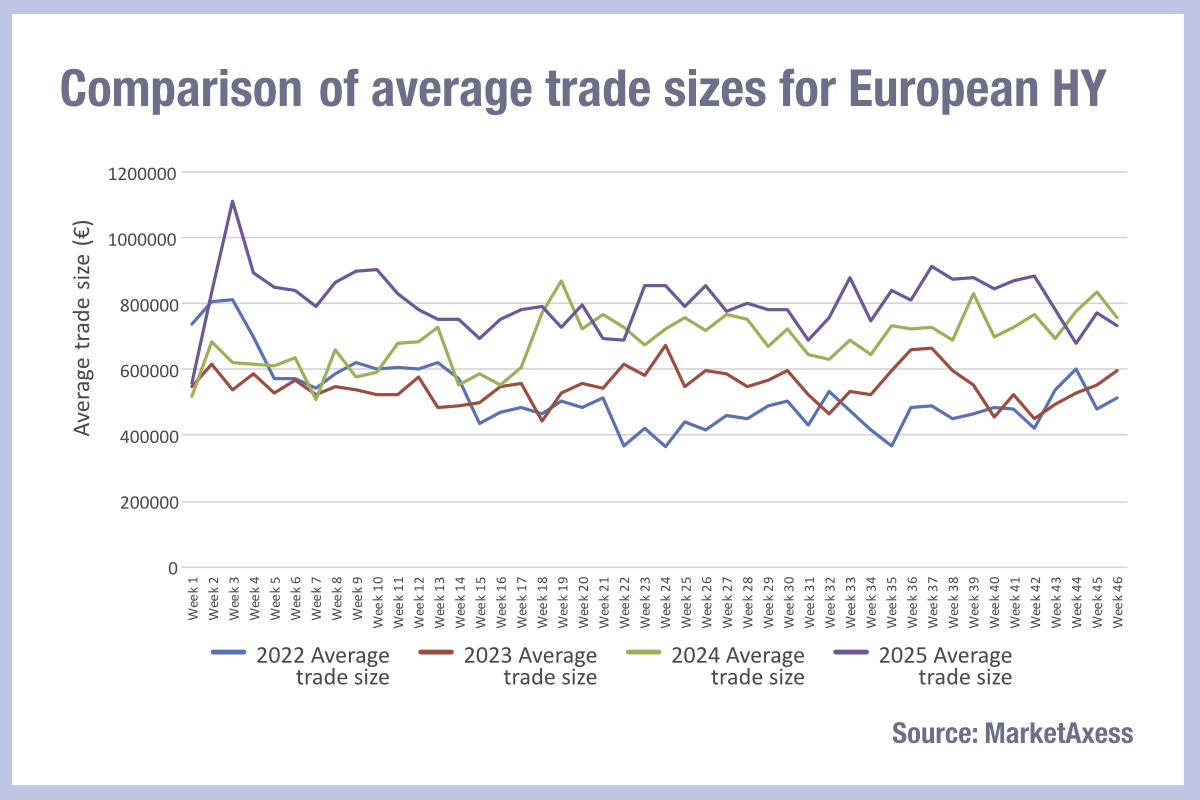

The gradual growth in trade sizes for European corporate bond trades is made clear in the latest MarketAxess TraX data comparison for data from 2022 to 2025.

Looking at the 46-week average (year-to-date for mid-November) of the past four years for investment grade (IG) trades, average sizes increased 15% between 2023 and 2024, and 13% again from 2024 to 2025.

Investment grade credit trades were outstandingly large in the first half of 2022 when markets were shocked by the Russian invasion of Ukraine, triggering large-scale position changes while volatility reduced confidence in taking on risk positions amongst dealers.

As a result average IG trade sizes fell 29% from 2022 to 2023. The average weekly trade size was €776,627 in 2022 for European IG trading in 2022, €554,962 in 2023, €636,623 in 2024 and €716,685 in 2025 year-to-date (YTD). If we take the latter 23 weeks of each year, to reduce the impact of the Russian invasion anomaly on trade sizes in 2022, average trade size that year falls to €658,581, and the percentage change become -18% 2022-23, +21% 2023-24 and +13% 2024 -25.

For high yield HY trades, the difference is a growth in trade sizes even with the early 2022 data included. Average trade sizes increased 6% between 2022-23 in European HY, up 25% between 2023-24 and 17% again to 2025.

If this is adjusted to the latter 23 weeks year to date for each period, the increase is 20% between 2022-23 and 29% from 2023-24, while increasing less, just 12% to 2025.

The data shows that liquidity has become increasingly available over the past four years, during a period of tightening bid-ask spreads in European and US markets.

©Markets Media Europe 2025