Can transaction cost analysis (TCA) provide an apples-for-apples comparison of buy-side trading costs across different asset classes? Imposing a single measurement framework across markets that do not share a common microstructure might seem impossible.

Can transaction cost analysis (TCA) provide an apples-for-apples comparison of buy-side trading costs across different asset classes? Imposing a single measurement framework across markets that do not share a common microstructure might seem impossible.

To some extent that is true. ‘TCA’ simplifies the way that buy-side trading desks measure the costs and quality of trading. While it can be used as a catch-all for the universal discipline of ‘trading quality’, explicit costs are neither universal, nor represent the whole universe of costs to consider.

In practice, a single model for TCA can fail to operate effectively across different asset classes because the underlying market structures, liquidity profiles, and trading behaviours vary widely, and the availability and capture of data and vary too widely for a single analytical framework or benchmark to capture.

The core premise of TCA – measuring execution quality relative to a benchmark and comparing it meaningfully between trades – simply does not hold when the mechanics around trading differ so that price formation, availability, frequency of execution and even trading fees differ fundamentally from one market to another.

Equities vs bonds

While equities have seen considerable changes in execution timing over recent years, such as increased trading at the close versus intraday trading, they are largely traded on transparent, continuously priced, central limit‑order books (CLOBs), and despite variations in timing the markets exhibit relatively stable quoting behaviour and consistent reference pricing.

Equities are largely invested in to reap rewards based on capital appreciation, making price the core element for understanding value, and frequently driving speculative price movements.

Consequently, it is reasonable to employ execution strategies such as arrival price, volume weighted average price (VWAP), and implementation shortfall because liquidity/pricing can be measured with reliability to benchmark their effectiveness.

By contrast, the infrequency of trading in many fixed income markets, driven by their buy-and-hold investment base and dealer‑driven, quote‑based secondary trading, compounded by the multiplicity of bonds issued by any one entity, can mean that bond prices are more frequently stale – some considerably so.

Returns from bond investing are largely based on their coupon, relative value and credit worthiness, the latter giving certainty over the former. Price movements are smaller than for equities and are typically less frequently affected by speculation.

The evolution of bond data

The big change that upturns this apple cart has been the expansion of quality bond data across fixed income markets, particularly the larger markets such as investment grade (IG), developed market trading, and the greater capacity to analyse large data sets.

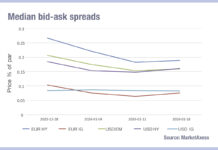

Strategies such as arrival price, which benchmark against the mid-point price between the bid-ask for a security, are only appropriate if that mid-price is available. In IG, for both US and European markets, this data is now commonly available, either as a commercial or a utility model (such as Trace in US and the developing consolidated tapes in Europe). Other instrument classes such as high yield are also following this path to greater transparency.

If a reliable reference price can be set, the same TCA metric which works for an equity can increasingly be used for a bond.

As long as the fair value of an instrument can be calculated, and the level of fair value given up during the trading process can also be calculated, then trading costs can be compared at a high level and analysis conducted across asset classes. For most fund managers, the level of transparency needed to ascertain whether an instrument is investible should also carry that aspect of fair value.

So, while effective cross‑asset trading evaluation can require asset‑specific and context‑aware benchmarks, and an understanding that execution quality is shaped by the unique liquidity ecosystem of each market, increasingly this is a possibility for trading teams working across assets. The less liquid – therefore less invested – fixed income markets may still be obscured, but change in those corners of debt trading is simply a matter of time.

©Markets Media Europe 2025