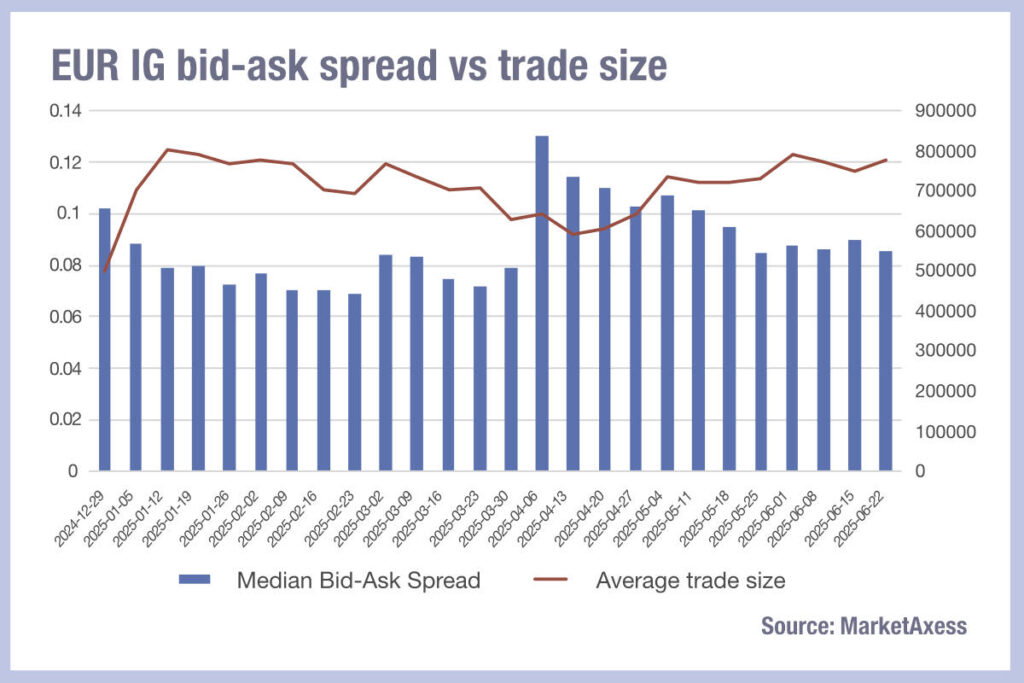

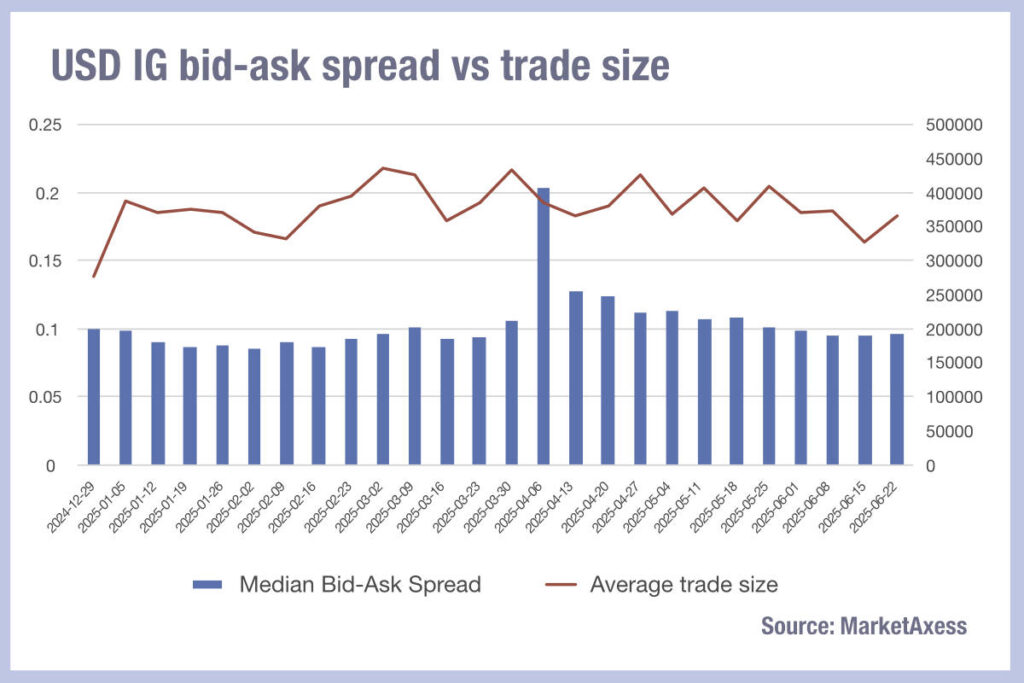

An analysis of average bid-ask spreads in corporate bond markets across the European and US markets suggests that median bid ask spreads responses are inverted against average trade sizes in European markets, relative to the US.

Looking at MarketAxess TraX data, which follows activity across multiple markets, and its CP+ data on pricing across markets, European investment grade trading has seen median bid-ask spreads tighten between April and May, from 0.13 bps at the start of April to 0.085 bps in late June, having held steady during June.

Average trade sizes have increased over that period, from below €60,000 in early April, to nearly €80,000 in June.

The US IG market has also seen median bid-ask spreads fall. Having hit 0.2 bps in early April – against Europe’s 0.13 bps – they dropped rapidly to 0.12 the following week, and have continued downwards, holding steady just below 0.1 bps during June.

Average trade sizes fell from the US$38,000 at their peak in April to US$36,600 in late June. This creates a curious parallel, with US markets seeing trade costs falling in line with trade sizes, while Europeans face smaller trading costs as larger trades become more common.

The answer may be that European brokers are facing more risk – and associated costs – with carrying corporate bond inventory. As a result they may be tightening bid-ask spreads to execute larger blocks of risk trading, if that presents less signalling to the market of their overall position.

In US markets, conversely, smaller trades are being executed at lower cost, which implies it is the efficiency of the trade processing which is lowering costs for dealers. The lower cost of risk carrying here may be due to the efficiency of e-trading; electronic market makers launched earlier in the US markets far tougher competition for smaller electronic trades.

©Markets Media Europe 2025