The electronification of the US corporate bond markets has demonstrated that its improved efficiency has strengthened depth of liquidity provision, rather than made it fragile.

Analysis of data from MarketAxess’s TraX data service, which follows activity across multiple marketplaces, and its CP+ composite pricing engine, shows that the turmoil in US markets created by the ‘Liberation Day’ tariffs imposed by the Trump presidency – and subsequent flip-flopping on the policies – may have shaken corporate bond markets, but they were able to resist any damaging impact.

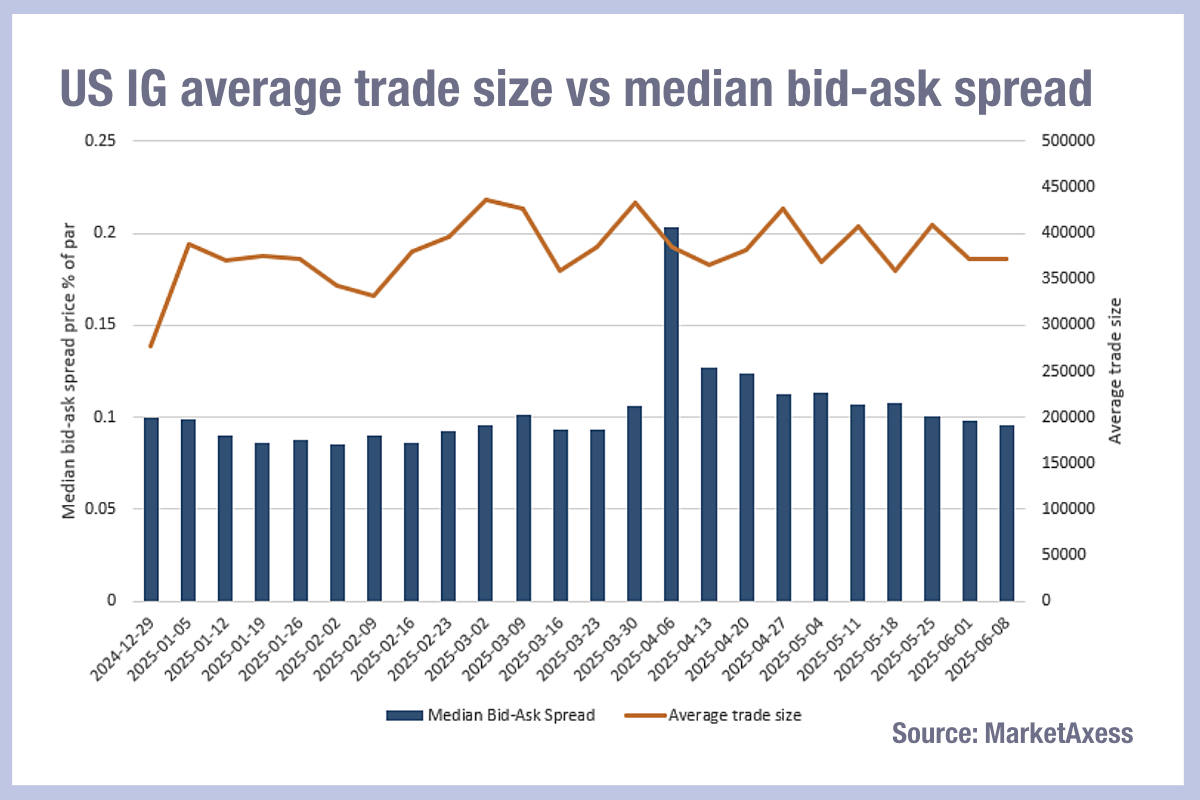

Looking at the investment grade segment, one of the most liquid credit markets, the shock of tariffs blew out the median bid-ask spread to double in size within a single week in April. Average trade sizes dropped a little in the following weeks but within normal ranges and continued to move in that range through May and June. Bid-ask spreads did not normalise as quickly; however they tightened continually over that period and by June were returned to the Q1 levels.

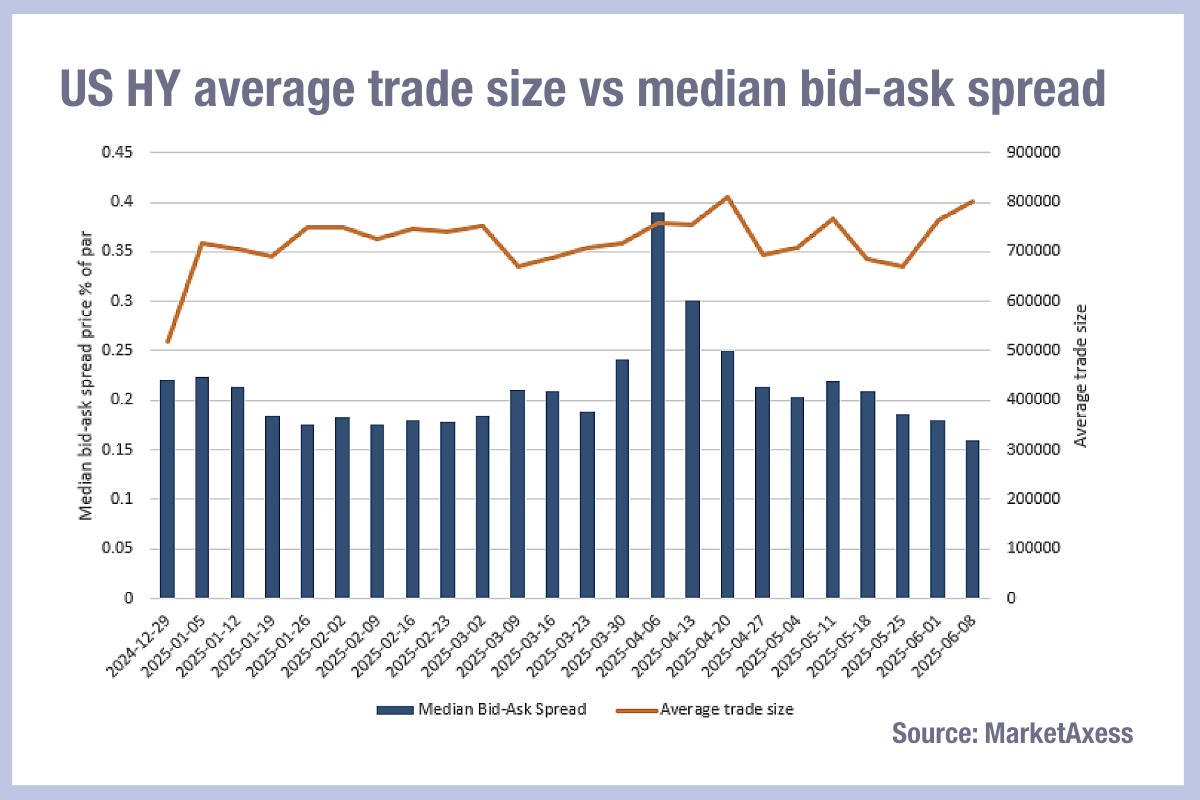

For high yield credit, the pattern was very similar with median bid-ask spreads having dropped below 0.18 as a % of par in Q1 and then nearly hitting 0.4 at the start of April. Trade sizes climbed from the end o Q1 to the beginning of Q2 and continued to do so into the middle of April, declining suddenly at the end of the month and then showing some volatility in average size into June.

Bid-ask spreads reduced in size over this period, with the median hitting its lowest level so far this year, in June.

Reading the data is key to understanding how to trade. Bid-ask spreads are a proxy for the cost of liquidity, and trade sizes are indicative of the size of risk that is being taken on by market makers.

Where the bid-ask spread has fallen and trade sizes either stayed flat or increased, it is indicative that the cost of liquidity is falling without the need to fragment orders into smaller pieces.

Consequently, the capacity to trade credit appears to be getting cheaper in US markets, despite a tumultuous episode, with a quick recovery and no market failure. Electronification has bene tested and proven.

©Markets Media Europe 2025